Soitec | An overlooked company with a unique™ moat

Leaking pipes, faux nationalization, and a winning Goliath

Threads and other finance-related tweets @AlaricsPicks

Before we begin, I wanted to thank anyone reading this. I am open to any feedback and would love to make this publication better. If you want to know a bit more about me and why I decided to start this Substack, I posted a very short introduction previously.

Executive Summary

When the word ‘semiconductor’ comes up, one would probably think of China, the United States, or Taiwan. Few would think of France as a a notable player in the semiconductor stage, as it pales in comparison to these giants. However, deep in the mountains of Isère, a region that includes Grenoble in the South-East of France, lies a national champion that few had heard of until recently: Soitec - Bloomberg ticker SOI:EN.

Soitec is a silicon-on-insulator (SOI) wafer manufacturing company. Wafers are a key step of the semiconductor value chain: they are the canvas that chips are designed on, and can greatly impact these chips’ efficiency. The principles of the SOI structures are a bit tougher to grasp, but they are simplified and broken down below.

While there are many wafer manufacturers out there, Soitec’s moat stems from its patented technology, Smart Cut™, that allows it to create more efficient wafers than others, and to do so at a cheaper cost than other SOI manufacturers. It has proven quite lucrative in the past five years, allowing it to overcome a dreadful entry into the solar market at the start of the 2010s decade, and near-bankruptcy in 2015. Now, it has put itself at the top of the SOI wafer market with a majority market share and great levels of profitability. Soitec’s strategy fits right into the grand trends of the next decade in the automotive industry, 5G and IoT, but doesn’t need them to take the world by storm. In the short-term, it is partially protected from inflation thanks to negotiating power over its main supplier and is not too exposed to armed conflicts between Russia and Ukraine.

However, it has been embroiled in a recent governance scandal that has overshadowed its financial prospects, falling 38% from its highs just two months ago, now back to late 2020 prices. As a result, its valuation has become more attractive. Although it is unlikely this investment will yield astronomical returns in the future, it could well beat the main indexes, leading the SOI wafer industry and its estimated 17% CAGR from 2021 to 2026. Support from France and the E.U with a recently-announced €43 billion investment package for the semiconductor industry is a welcomed boost too.

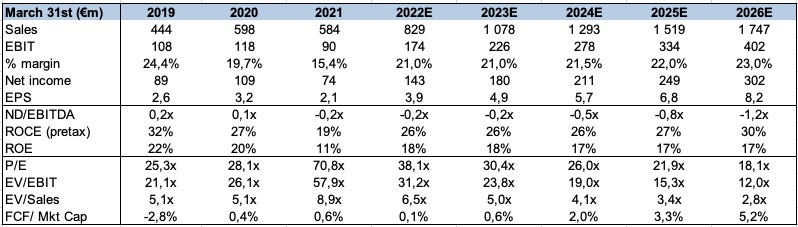

Please note that the company’s fiscal year ends on March 31st, thus it is currently in Q4 of FY 2022. All ratios are from Monday, February 14th’s closing price of €149.0.

Price target: €202

Upside: 35%

Looking at financial ratios, the company is definitely expensive, trading at 19.0x 2024E EBIT for instance. Yet, I believe a DCF tells only a fraction of this story, and that analyzing the firm’s strategy and positioning can allow one to see it could be valued significantly higher. I did not want to tinker with the model too much, sticking to adjustments that I could explain and not arbitrarily changing previsions to reach a higher upside. Instead, this upside is more or less a baseline from which one can start, and I will let the readers decide what they estimate the value of the company is after reading through this analysis.

This story involves financial deep dives, politics, a leaked pipe, and a winning Goliath.

Business Overview

Soitec is a French semiconductor company founded in 1992 by André-Jacques Auberton and Jean-Michel Lamure. They were both former researchers of the CEA-Leti, the microelectronics and nanotechnologies research arm of the French Commission for Atomic Energy and Alternative Energies (CEA). Both of them are no longer with the company.

Soitec went public in 1999, and has been through several different product phases. A pivot in strategy that proved near-fatal was its entering of the solar market in 2010. The mistake was two-fold:

It entered the wrong division of the market: solar photovoltaic is the part that took off, yet Soitec went with solar CPV (solar concentrated photovoltaic). The latter did not see as dramatic drop in prices as ‘regular’ PV panels, thus the industry collapsed quickly. From 2007 to 2017, CPV represented a measly 0.1% of total utility-market solar power installations.

It entered the solar market: even if Soitec had picked solar PV, it would have likely still been decimated. Western solar panel manufacturers were crushed between the late 2000s and mid-2010s when cheap Chinese panels flooded the markets, leading to the demise of many heavy-hitters, including White House-backed Solyndra.

This led Soitec on the brink of bankruptcy in 2015. A new internal CEO, Paul Boudre, was promoted. Through his leadership, the company refocused its activities on its core business of electronics while divesting its solar activities. Between late 2015 and late 2021, profit margins soared, revenue more than doubled and shares rose over 1,900%.

Soitec has achieved its turnaround story with great success. Yet, despite these recent excellent years, I believe Soitec has substantially more to offer. Let’s see what made it reach today’s heights, and how it can get much better from here.

Semiconductors, SOItec & Smart Cut™

It’s all in the name: Soitec stands for Silicon-On-Insulator (SOI) Technology. In short, it provides a partial solution to the slowing down of Moore’s Law.

In long: we have to go back to 1965. Bear with me we’ll time jump soon again. That year, Gordon Moore famously observed that the number of transistors in a dense integrated circuit doubles roughly every two years. This proved to be true for four decades, when the doubling started occurring every six years (Amdahl’s law) and since 2015 the doubling is expected to happen every twenty years. We can see the problem getting exponentially worse: more power and efficiency is constantly required for new iterations of devices, yet the amount of transistors in a circuit isn’t keeping up. They have shrunk dramatically in size, but in recent years scientists have feared we are reaching the limit of what is physically possible. For reference, the industry standard is currently 7 nm transistors, and some lab experiments have made it to 2 nm, but going significantly below that size is extremely doubtful. So, going for more isn’t working, but what about going for better? That’s where SOI comes in.

Building transistors within a regular doped silicon substrate (i.e silicon modified to be more conducive) allows for ‘leakage’ of electrons, which essentially means less efficiency. Some SOI such as Fully Depleted-SOI also create shorter ‘gates’ between which the electrons flow, enabling faster computing processes.

To keep things simple, have the following image in mind. Imagine you want water going from your heater to your shower. A regular transistor would be like using a leaked pipe, and having that pipe go through your garage, living room, and bedroom before reaching your bathroom. A transistor made with SOI would be like having a perfectly sealed pipe going from the heater to your shower pipe in a straight and short line.

Source: STMelectronics. Among its perks, FD-SOI allows for much lower leakage, while also having the option to favor power instead of leakage (similar to an off/on mode)

There are different kinds of SOI technologies, each adapted to different uses. Some transistors may need to be especially efficient in terms of power use, others in terms of raw power, etc.

Source: Soitec FY2021 Annual Report

The cylinders above are what Soitec makes. Soitec doesn’t create transistors nor the actual chips you can see inside your phone – here’s to hoping you never actually got to see them. Soitec manufactures these cylinders, called ‘wafers’. They are extremely thin in real life so they would almost look a plain circle. Wafers are the building blocks of chips. Foundries cut wafers in tiny squares to start the chip-making process. Wafers themselves are the result of heated silicon ingots that are then shaped into cylinders that are then slit into these thin wafers.

Now, plain wafers are easy to make and over 50% of global production comes from 5 companies. Specialized wafers such as SOI wafers make up a slightly more fragmented market. Still, manufacturing SOI wafers isn’t very uncommon. What makes Soitec stand out from its competitors is its Smart Cut™ technology (yes, it’s trademarked, and no, I haven’t found the short key to write ‘™’).

The importance of Smart Cut™ technology cannot be understated:

Quality: it offers market-leading quality: perfect transferred layers and good thickness homogeneity.

Cost: it is a generic and adaptable process based on standard semiconductor-processing tools, allowing for both simple scalability and customization.

Reusability: the process involves two wafer layers, one of which can be reused after the process is completed

Source: Soitec.com

So, Soitec’s patented Smart Cut™ process takes care of the cost problem that has long plagued SOI manufacturing, enhances its quality, and allows for reusability: a trifecta.

It is also far from a speculative technology: the process was invented in 1992 and patented by Soitec shortly after its creation. It has proven its use over two decades, so much so that Japan’s Shin-Etsu Handotai and Taiwan’s GlobalWafers, respectfully the world’s first and third biggest silicon wafers manufacturers, have licensed Soitec’s technology for years (since 1997 for the former), with renewal negotiations scheduled in 2023.

While the technology has existed for three decades now, it has been fine-tuned over time, and more importantly it has become necessary since the substantial slowing of Moore’s Law. To put in bluntly, Soitec is the only company in the world with the intellectual property that allows for cheap and efficient production of the foundation of modern efficient chips.

I should mention that FD-SOI, a pillar of Soitec’s future growth, is challenged by finFET, a technology created by Intel. However, finFET is mostly for applications that need ultimate performance such as PCs and servers, whereas FD-SOI is made for IoT and other lower-end applications. FD-SOI and RF-SOI also require much cheaper production processes.

As you may have guessed, the market for SOI wafers is booming. Research firms on average estimate it will grow at a CAGR of c.17% from 2021 to 2026. The SOI products market should reach $2.3 billion (c. €2 billion) by then, up from $1.1 billion (c. €0.97 billion) in 2021. According to Soitec themselves, the company has a 77% market share in the SOI wafer market – and research firms say it owns ‘the majority’ of the market. All things equal, that would put Soitec’s 2026 sales around €1.55 billion. Yet, the company is expected to gain market share, notably with it plowing over €1 bn in CapEx for manufacturing expansions near Grenoble, also in Belgium, and in a Singapore plant. It should reach yearly capacity of 4 million wafers in 2026 against 2 million today. It is also expected to enter new wafer markets outside of SOI although they are rather marginal so we won’t go into these details. Altogether, these projections have led the company to announce $2 billion (c. €1.75 billion) in sales by FY2026.

The global wafer market was valued at c.$17 billion (c.€15bn) in 2020, with the silicon wafer submarket at c.$11 billion (c.€9.7 bn), the latter being led by Shin-Etsu Handotai with about 30% market share. Soitec has roughly 5.5% of that market. The silicon wafer market is scheduled to grow at a slower pace than the SOI market: analysts predict about 6% CAGR from 2022 to 2026; and the global wafer market at an even slower pace of c.4.7% CAGR in the same period.

So far, a major driver of demand has been smartphone manufacturers, that need RF-SOI – Radio Frequency SOI – in their technology to ensure efficient communication through 4G. Future demand however, will come from 5G, the automotive industry – especially with the rise of EVs that require much higher computing power than ICE cars – and IoT applications.

At first glance, 5G, EVs, and IoTs are Wall Street-beloved buzzwords that make some skeptics grind their teeth. 5G is sometimes lauded so much that it seems it could cure cancer (or cause it, if you’re in the wrong Facebook groups). How impactful these trends are in our world and how fast they arrive is up for debate. What is fairly reasonable to assume however, is that they will occur in a non-negligible way: sales of EVs are on a continuous rise, IoT products are becoming more and more commonplace, and 5G may have had a rough start (and still for years to come) but it is ultimately 4G’s replacement. The great thing about this business case is Soitec doesn’t need these trends to be explosive or take the world by storm, it just needs them to be on a rather steady path. At a market capitalization of c. €5 billion, it is still a small player in the overall semiconductor industry with room to grow, so it needs these gigantic future markets to just not totally collapse.

Investment Summary

Qualitatively, we have seen that Soitec is a great business, but now allow my intern skills to shine and present the conclusions of the modeling part of this analysis.

Soitec is an expensive business. The numbers below will show it. However, I’d rather buy a wonderful company at a fair price than a fair company at a wonderful price – come to think of it, this should be a quote.

Disclaimer: the company’s fiscal year ends March 31st, it is therefore currently in what it calls Q4 FY2022.

Based on FY2022E, Soitec trades at 38x P/E, 6.5x Sales, 21.8x EBITDA, and 31.2x EBIT. These numbers look especially bad when compared to peers:

In terms of products, GlobalWafers and Shin-Etsu Handotai are the closest to Soitec, but have substantially larger market capitalizations. Siltronic and IQE have slightly different offerings, but are closer in terms of market cap, especially Siltronic.

However, these numbers must be put back in the context of growth. Soitec is expected to grow by about 15-16% CAGR FY2022-FY2024; whereas half of that is expected from the average of peers:

This is part of what makes Soitec special: it is a profitable company, with good FCF in a CapEx heavy industry, growing at 16% CAGR 2021-2023, same goes for 2021-2026. Regarding profitability, Soitec has had positive operating cash flow every year since its restructuring, and positive FCF every year except for 2018 – it will likely have near-zero FCF for FY2022 due to massive CapEx investments.

The company plans to reach c.$ 2 billion in sales by FY 2026 – so essentially 2025. It also forecasts company-adjusted EBITDA to have a 35% margin. Soitec’s EBITDA adjustments stem almost exclusively from stock-based compensation and provisions (mainly for retirement benefits) adjustments.

Regarding FY2026, valuation ratios are: 18x P/E, 2.8x Sales, 8.6x EBITDA, 12.0x EBIT.

The price target was the result of the aforementioned DCF. Here is a brief breakdown of its main components until 2026:

Sales – expected to grow 42% for FY 2022, then 30%, 20%, 17.5%, 15% and 15%

EBITDA – own, not company adjusted – margin is scheduled to be 30% of sales this year, and grow to 33% by 2026. Apart from COGS – c.36% margin by 2026 – R&D expenses are what weighs on EBITDA the most. The company plans on continuously spending c.13% of revenue on gross R&D expenses. Soitec has benefited from French R&D subsidies for most of its existence, and the most recent two-year average was of about 40% of gross R&D.

D&A – set at 9% for every year until 2026, which is slightly lower than the FY2021 and H1 FY2022 numbers. The D&A % has increased every year since restructuring due to continuous CapEx investments.

Tax rate – Set at 22% from FY2025 onwards. Soitec has had extremely low tax rates since its restructuring in 2015, benefiting from substantial tax loss carry-forwards. Given the rate at which Soitec is using them and expectations of strong profitability, they should run out by FY2025.

Change in NWC – Average of -6%, then 0% for TV. This one needs nuance. Given the formula for change in NWC, increases in inventory and accounts receivable, and decreases in accounts payable, lead to lower FCF. Looking at Soitec’s balance sheets over the previous years, accounts receivable and payable both started at c.€40m in FY2016, but the former tripled in value while the latter only doubled from then until FY2021. Inventory started at c.€30m and quadrupled in that same time period. It’s important to notice that the majority of inventory growth during that period isn’t due to finished goods waiting in a warehouse but due to an increase in raw materials: Soitec has been expanding its production capacity rapidly but likely not fast enough compared to its internal sales expectations. Furthermore, as sales grew at 17% CAGR in that same time period, accounts receivable were bound to follow given the nature of the industry: c.60% of sales has come from five customers over the previous five years, thus these customers place massive bulk orders which are usually paid out in tranches. To conclude, the change in NWC systematically has a ‘negative’ impact on FCF here, but it isn’t due to difficulties in sales, but more so production and the nature of the industry.

CapEx – Fluctuates, but has an average of 18% of sales each year until 2026. As previously said, the company expects to invest c.€1.1 billion in production capacity from FY2022 to FY2026, and to do so only with cash-on-hand and operating cash flow.

WACC and TV growth rate – 6.5% & 2.5%. While the former may seem low, a look at the firm’s balance sheet tells a different story. WACC can be seen as either a risk discount, or an opportunity cost discount. The issue is, sometimes these two diverge too much. The CAPM deservedly has its fair share of criticism, but it’s quite straightforward for Soitec. The cost of equity is around 10.8% – and weighs c.57% – and the cost of debt is at c.1% – and weighs 43%. The cost of debt is very small thanks to the low-interest environment but mostly thanks to Soitec’s funding structure, as over two-thirds of outstanding debt are convertible bonds with 0% interest rates – their dilutive effects are taken into account in total share count. The TV growth rate was used as a mix of growth expectations from the SOI wafer industry, the overall semiconductor industry, and growth of target Asian countries – the Asian market is now c.60% of sales and growing fast.

Net debt - Set at (€15m), thus essentially negligible. ND/EBITDA has not been higher than 0.4x since FY2016. Soitec has never needed substantial leverage since its turnaround.

We should also note that Soitec has made almost no major acquisitions since its restructuring in 2015. The only significant one was the acquisition of EpiGaN in 2018 for €34m – no other financial details were given – a producer of epitaxial wafers used for RF applications, and soon in many 5G devices. It also made the acquisition of NOVASiC in late 2021, a company specialized in silicon carbide wafers which are used for power electronics such as in EVs, but no price details have been given for now.

Sales growth has thus almost exclusively been organic in recent years:

Products: The 300 mm SOI wafers have seen the fastest sales growth, increasing five-fold over the past five fiscal years, and going from 23% of sales to 53% of sales in H1 FY2022. Another category is the small diameter products, i.e 200 mm and to a much lesser extent 150 mm wafers. Oversimplified, this is due to FD-SOI being in high demand while only being produced on 300 mm wafers, and the size of these wafers being favorable given they logically allow for more dices per wafer – literally cutting the wafers into small squares. The final category is comprised of royalties from a JV the firm has with MBDA and the licensing of its Smart Cut™ technology to Shin-Etsu Handotai and GlobalWafers. Operating margins per products are not given by Soitec.

Region: Asia is now the driver of sales growth, overtaking Europe in 2019. It now grows around 55% p.a and is scheduled to keep doing so in the next several years. European sales growth has slowed down, from over 40% p.a in the mid-2010s to 25% p.a today. The U.S is also slowing down, from around 25% p.a in the mid-2010s to 15% p.a today.

Smart devices end customers are expected to keep representing 15% of company sales by FY2026, whereas the automotive industry should double its share from 10 to 20%, and mobile communications should drop from 75% to 65%.

The company also has great returns on capital, equity, and assets, given the wafer industry:

c.20% ROE average in 2018 and 2019, 17% in H1 2021: over x3 the industry average

c.30% ROCE average in 2018 and 2019, 24% ROCE in H1 2021 – could not get data on industry average

c.11% ROA in 2018 and 2019, 8% ROA in H1 2021 - over x2 the industry average

Risks & Misconstrued Risks

Soitec may have a great moat, it is not immune to various risks. Let’s break these down into general risks and company-specific risks.

Among the general risks, let us immediately talk about the horde of elephants in the room: interest rate hikes, inflation, and the potential invasion of Ukraine by Russia.

Interest rate hikes are probably Soitec investors’ biggest risk, but not as much of a concern for Soitec itself.

Rate hikes can be problematic since they increase the cost of borrowing for a company and increase the discount factors of future cash flows. If the Fed, and more importantly here the ECB, were to raise rates, Soitec would still do business fine. The company is almost net cash, and most of its borrowing is done at 0% interest through its OCEANE convertible bonds. Issuing future convertibles with a 1% to 1.5% interest rate would be far from dramatic. If these bonds had had a 1% interest rate in FY2022, it would have created an additional debt service of €4.75m, or less than 0.6% of projected revenue, and never mind the tax shield.

The real problem wouldn’t be for Soitec’s operations, but for its investors. Most of Soitec’s equity value comes from its future cash flows. Increasing the WACC by 50 bps slashes the upside potential by half, increasing it by 100 bps brings the price target down almost to current market value. There is genuinely nothing that can be done here without involving other hedging financial instruments. On its own, the investment in Soitec involves dangerous exposure to an increase in interest rates.

Other macro risks however, are not nearly as worrying.

Inflation is running hot at the moment, although not as hot as articles about inflation. In January 2022, it reached 7.5% in the United States and 5.1% in the eurozone. Soitec is obviously being impacted, but I believe it can have some protection. It can’t do much about things such as cost of energy, however it can act on its customers and suppliers.

Customers: Soitec has a highly concentrated customer base, with the top 5 making two-thirds of sales. These include GlobalFoundries, STMicroelectronics, UMC, and Tower Jazz - in no particular order, and Soitec doesn’t mention the fifth one for an unknown reason. Something to note is that Intel recently announced they would acquire Tower: this could be an interesting catalyst if Intel decides it likes Soitec’s impact on Tower and signs a contract with the firm, it could also be dreadful and lead to Intel cutting that contract to favor its current suppliers. The quality and cost of Soitec’s SOI wafers is unrivaled, so it has some leeway in terms of pricing. Yet, concentration overshadows this, and makes customer risk a real and substantial one.

Suppliers: this one is especially interesting. We will focus on recurring suppliers – therefore not CapEx-linked suppliers – as we have data on them. Including custom duties, in FY2020 and FY2019 respectively 77% and 82% of inventory purchases (raw materials and goods held for resale) were raw materials. Shin-Etsu Handotai, the world’s largest wafer manufacturer and a Soitec shareholder (we will get back to that fun coincidence below), accounted for c.67% of Soitec’s raw materials purchase in both years (€142m and €175m). So, Shin-Estu Handotai is an absolutely crucial supplier to Soitec. Yet, it supplies plain vanilla wafers to Soitec, so why aren’t they diversifying their supply chain? Except for savings on bulk buying, it is because this relationship is deeper than it seems. Not only is Shin-Etsu a shareholders (with less than 1% of Soitec’s capital, less than 2% of voting rights but with a board member), if you recall we mentioned that it has been licensing the Smart Cut™ technology for for over two decades. So, both parties have something more to gain than in a usual buyer-supplier agreement.

Shin-Etsu has a market cap of €58 billion, over 10 times Soitec’s market capitalization. But I believe the David and the Goliath of these stories is the opposite of what can be thought of at first glance – for the sake of my analogy, Goliath wins in my Bible. Shin-Etsu is a conglomerate made up of several businesses, the biggest one being the Semiconductor Silicon division, making 22% of sales and 33% of operating income – by far its biggest profitability component. This business sells SOI silicon wafers and compound semiconductor products. In 2019, that generated c.€1.1bn in operating income. On the other hand, royalties, which include licensing Smart Cut™ but other revenue as well, made up 5% of Soitec sales, with Shin-Etsu royalties likely not making more than 2% of Soitec sales. So here’s the equation:

Soitec uses Shin-Etsu as it main suppliers for standardized technology that it could get elsewhere, and 2% of its revenue at most comes from Shin-Etsu royalties. Shin-Estu sells raw materials to Soitec but most importantly uses Soitec’s Smart Cut™ to operate its division that contributes the most to its profitability – although it is impossible to estimate how much. The power struggle is thus in Soitec’s favor: it can always leave and find a new supplier albeit at a slightly higher cost and lose less than 2% of sales by not renewing the Smart Cut™ licensing agreement in 2023, the next scheduled date. Shin-Etsu cannot afford to lose that technology as it allows it to operate at a cheaper cost in a booming and important market for a company that only recently reached double-digit growth again.

The conclusion? Shin-Etsu will have to maintain very favorable pricing for Soitec – but not loss-making prices either to avoid flirting with the law. Soitec is therefore well positioned to have over half of its supply costs maintain a reasonable price.

Moving on. The war. There is little to say here: if war were to be declared, energy prices would rise and incur further costs for Soitec. However, it would not result in a significant increase in Soitec’s raw material purchases: Soitec mainly buys wafers made from silicon, 64% of world production coming from China and only 9% from Russia (with India and the US not too distant). Rare earth materials it uses also do not come from Russia, but China. Let’s hope for no war with China.

Regarding company-specific risks, there are also three that Soitec has to deal with: execution of CapEx, cyclicality, and a governance crisis.

The first is rather simple: it needs to execute well on its CapEx plans. Production has sometimes lagged a bit, and in an era of high demand this would be a tremendous waste. As mentioned before, Soitec has great ROCE and ROE, so I wouldn’t be too worried.

The era of high demand brings me to the second risk: cyclicality. The world of semiconductors it cyclical, with undersupply leading to major expansion expenditures, which then leads to oversupply which then leads to a drop in prices and earnings.

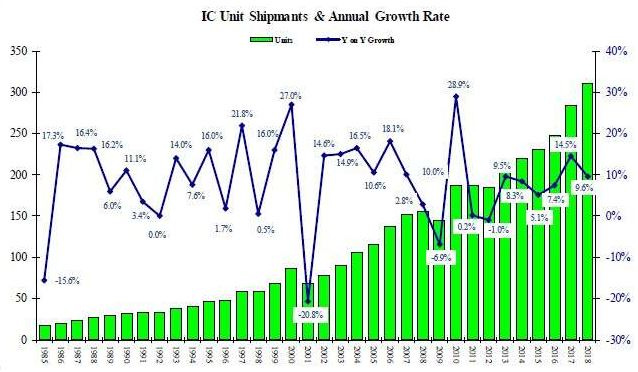

Evolution of Integrated Circuit Shipments and Annual Growth Rates from 1985 to 2018. Source: Future Horizons

Soitec seem little concerned with that cyclicality given their CapEx projections, and there is a legitimate reason to agree with them. While the semiconductor industry is still cyclical, the % drops in demand are becoming smaller and smaller. Contractions still last roughly twelve months every five to six years, although they are shortening recently, but they are not as impactful as before. This is due to the ever-growing importance of semiconductors in our lives, where new products almost systematically require additional processing power. Thus, Soitec will likely see a one-year sales slump in the next five to seven years, but all things equal it should not change this investment thesis.

The third risk is entirely different: governance. Soitec made headlines in France went the star CEO Paul Boudre, who helped save the company in 2015, was abruptly ousted by the Board’s Nomination and Governance Committee earlier this year. The stock price collapsed by over 20%, and has not recovered since. This is the consequence of behind-the-scenes politics worthy of an episode of House of Cards, and it would require its own post. If you want to dive deep into it, here is an excellent article by writer Fabricated Knowledge that sheds light on the situation.

To sum it up, Soitec allowed a Chinese company, NSIG, to buy c.14% of its equity during its 2015 woes, with Paul Boudre reportedly liking the idea of cooperating further with them. Later, Covid happened. The French government, like every other government, realized just how important it was to have a national champion in the semiconductor supply chain. Thus, it slowly but surely made sure to have control of the firm. It did so through its BpiFrance Participations, a French Public Investment fund, and CEA Investissement, which now hold a combined c.18% of total shares and likely over 20% of share votes. The actions included the appointment of a new Executive Chairman that had no ties with China, putting pro-France board members on the most strategic boards, several extraordinary committees giving board members more powers than the C-suite, and the purchase of additional shares. It should be known that Soitec has refuted these theories and simply said the new CEO, Pierre Barnabé, was better suited to take the company on a global scale.

While Fabricated Knowledge concludes that France has nationalized the firm, I wouldn’t that go far, nor would I have a dramatic view on the matter – and I promise that my inner French isn’t the one speaking here. The question is, how is Soitec negatively affected by this?

Source: Soitec.com

The most inevitable answer is that a buyout offer from a foreign firm is off the table. Any offer from now on would likely end up like Taiwanese GlobalWafers’ bid on German wafer manufacturer Siltronic: in the bin. That creates a problem beyond a cash out for shareholders: if other players consolidate or grow faster, Soitec may get left behind and suffer in terms of profitability. Yet, while semiconductor companies were consolidating for the past two decades, things have considerably slowed down in the past couple of years due to authorities increasingly seeing such companies as strategic assets.

There are legitimate fears that the new external CEO is not qualified, or at least as qualified, as Paul Boudre. I agree, but don’t assume it will necessarily be a negative either, the problem is Soitec has gone from an excellent CEO with a proven track record to a coin toss in terms of odds of success. Yet, the nationalization fear is overblown and I see it in a more positive light: France wants to protect its semiconductor champions and develop the industry. That means more R&D credits, more overall tax credits, more low-cost loans. The government has no interest in tanking this firm by blocking it from selling in various markets or through other interventions. A Macronist government would likely want to cozy it up and help it grow rather than turning it into an inefficient state tool. The only clear limit established so far is no buyout from foreign powers, and limited technology transfers with China, which is reasonable in my view.

Perhaps the company will at least score a point by buying back shares after this drop, showing their confidence in a new CEO. It has a 5% share buyback in place which expires this April. However, the data shows it wasn’t used during H1 2022, just like it didn’t use its two other buyback programs in 2020 and 2019. The company currently does not issue a dividend and does not plan on doing so for the next three years at least.

ESG

The governance issue leads us to the last element of the analysis: ESG.

We have just covered the G part, but regarding E and S there are a few things to note:

Environment: The company inherently works in a polluting industry: while oil producers and airline companies are often blamed, the semiconductor industry is far from a green one. The energy and water needed to create chips is one thing, but more importantly the components of those chips are made up of rare earth materials that often pollute the soil they are extracted out of. Even the production of silicon is a major climate issue. While it is known as the 2nd most abundant element in the Earth’s crust, making 28% of its mass, a Liliputian amount can actually be used in semiconductors, that actually require a certain level of purity. These amounts are sometimes dug out of rivers and fragile seabeds. Soitec is trying to make changes on its individual footprint, but it can’t escape the very nature of its work.

Social: there have been several worker strikes at Soitec over the years, all at their French factories. The demands are based on work hours, pay, and labor conditions. The latest was in 2021, but it did not last long. Also, they are eligible to share compensation plans – they currently own 1.5% of the capital. The company is actively working on improving gender equality, now reaching 94/100 on the gender equality index.

Closing thoughts

Peer valuations and discounted cash flows sometimes fail to capture the value of a company. While the DCF gives an interesting upside, I believe what we have seen here is that there is much more to this company than models show. It will be materialized in financial numbers somehow of course, likely with an even further increase in sales growth and slightly higher margins, but I did not wish to input what I wanted to happen on my model, but rather what could most likely happen.

Soitec looks like a fantastic business. It has a clear moat, has refocused its efforts on it after diverging too much from what made it great in the first place, and is now positioned to capture the mega trends of the next decade. It is currently overshadowed by a temporary failure by Board members to show that they wanted to protect France’s interests and macroeconomic fears.

Again, if anyone reading this has some feedback I would gladly appreciate it to hone this publication as much as possible!

Thank you.

Disclaimer: The contents of this article do not constitute financial advice, please conduct your own due diligence.

Great write-up, I'm curious if you've looked into moonshots for SOI and III-V compound based technologies? I think it's relatively hard to quantify, but once you start thinking about the potential market size it's hard to crawl out of the rabbit hole. If the following is even slightly directionally correct, Soitec & IQE can be 100x baggers:

Solar (yes, the horror story): Thermal PV adoption (think solar farms, nuclear plants, etc), transparent PV adoption (think cars, buildings, green houses etc), special-use solar (think EV, or special conditions like space)

RF: smartphone & base stations (lower growth), space-based (higher growth, Starlink terminals)

MicroLED: CMOS backplane for headsets, other consumer products

Photonics: co-packaged optics entirely based on SOI, with III-V LD/PD integration, complete phase out of copper, quantum computing lasers

Sensing: LiDAR for cars/smartphone/headsets, LD/PD for health sensing

III-V based ICs

These are all valid potential markets (many with high volume/huge die size) once III-V epi can get cheap enough, with throughput fast enough. Not sure if Smart Cut can play a role on saving substrate cost for III-V.

Very good job and very interesting, thanks.

There's just one big thing that squeals.

You say:

"The power struggle is thus in Soitec’s favor: it can always leave and find a new supplier albeit at a slightly higher cost and lose less than 2% of sales by not renewing the Smart Cut™ licensing agreement in 2023, the next scheduled date. Shin-Etsu cannot afford to lose that technology as it allows it to operate at a cheaper cost in a booming and important market for a company that only recently reached double-digit growth again."

My main concern is that this might be an understatement of this risk. From the annual report:

"SEH obtained an operating license for the Smart Cut™ technology in 1997 and renewed it in 2012. This license entitles SEH to operate the technology independently and requires no operating interaction beyond declaring their sales;

Could this mean the technology is already in the hands of the Chinese? Relations are still polite because they own a little stake and a board member, but could Shin-Etsu perfectly leave Soitec without its business being affected?