Sofa Carpet Specialist | Not another value trap

Administration, minority shareholders, and cash under the...sofa

I provide further information on companies I have analyzed and talk about other equity-related topics on Twitter @AlaricsPicks

In the popular Belgian comic Cédric, the boy’s father is systemically belittled by his father-in-law for selling rugs. The former is often called in a mocking tone a “vendeur de carpettes”, i.e a tiny carpet salesman. Little would the family patriarch know that such a business could have paid for his pension five times over if he had given his son a little encouragement to launch a 100-store chain such as ScS.

An affectionate grandpa. Source: “Quelle famille !”, Cédric Best Of Edition 6, DUPUIS

ScS is the acronym of the pragmatically-named Sofa Carpet Specialist, a small U.K retailer that sells home furniture and flooring.

The company trades below net cash and is debt free - barring leases. Such statements will have just about every fund manager ready to berate young analysts and telling them that it is just another so-called “value trap”.

Yet, it systemically generates free cash flow, even during the 2020 Covid-19 lockdowns, and while it should burn some cash in the following months, its net cash position should remain almost unharmed.

This, combined with a shareholder friendly policy, a negative working capital model, great cost control, and a number of catalysts we will see below, has made ScS an outlier among U.K retailers.

Now, sit back on your sofa - or your carpet - and let’s dive in.

This is my first post after several months off, I will try to maintain slightly greater posting consistency in 2023. Thank you for reading!

Executive Summary

Please note that ScS uses a fiscal year (FY) ending on July 31st.

All references to the stock price such as multiples and upside are based on the price at closing on December 30th, 2022: 161 GBX.

ScS Group plc (Bloomberg ticker - SCS:LN Equity) is a £56m micro-cap U.K-based home furniture retailer trading 50% below its highs from 18 months ago. It trades at 1.1x book value and more importantly at 81% of net cash, far further below any other time since its second IPO in 2015, all the while having no debt, minority shareholder-friendly distribution policies and burning little cash in the upcoming couple of years. The company’s valuation has tumbled from inflation then recession fears, as, apart from its status as a consumer staples company, it is a business that should be exposed to today’s biggest headwinds. Yet energy and wage inflation, higher interest rates, a mild recession and an uncertain supply chain should not be having a material impact on ScS’s valuation.

The company’s business model is actually resilient to most of these issues, as:

The company has no debt and hasn’t relied on it for years

It is located in a value-for-money segment, and has great relationships with its clients

ScS’s business model uses negative net working capital and more importantly most of its products are made-to-order, allowing for great inventory management

Energy accounts for a small percentage of total expenses

Wage renegotiations have long been part of ScS’s business

ScS should provide at the very least a 6.5% return in terms of dividends and buybacks over the next 12 months, up to 13.7% if it abides by the more lenient end of its dividend restrictions and profits only halve from the previous year, while having capital appreciation upside of 75% for a share price of 282 GBX.

Buybacks and dividend returns seem highly likely thanks to its minority shareholder-friendly position, with the company hiking its final year dividend in November - which has already been paid out - despite market conditions, and aggressively buying back shares as recently as a couple of days ago. These could be distributed while the company sits on £71m in cash and no debt, all the while generating free cash flow or being near breakeven every upcoming year except for FY2023.

Regarding catalysts for the DCF upside, these include:

Half-year results in March. ScS should see a not-so-dramatic sales drop, while we have modeled a conservative 10% fall in sales. It could present also an increased cash position despite buybacks, as the company announced in October its cash position had increased even if it operates in a tough macro environment and aggressively buys back shares. Given the company’s net working capital model and its complexities to be seen below, free cash flow results should also surprise to the upside.

Holiday season trading results. ScS gives frequent updates on like-for-like order intake growth, and given recent results and the company’s resilience, sales numbers could be much higher than expected.

Shareholder activism. Some funds have significantly increased their positions in recent months, including an activist fund. They could push ScS to increase shareholder distribution.

Macroeconomic changes. ScS does not need interest rates or inflation to collapse to see its valuation justified. However, a slight change in inflation rates and consumer confidence surveys could provide investors with optimism and rerate the company that has been unjustifiably thrown out along its peers.

Forecasts for the company’s results are purposely thoroughly pessimistic, as the analysis sought to bring as much margin of safety as possible.

ScS generates substantial cash and has near 30% ROIC and over 25% in ROE most years. It trades at a historically-high forward P/E ratio or nearly 20x - or just over 7x according to analyst consensus - and a poor FCF / market cap ratio, but these multiples are computed with a conservative view, are likely to be one-offs, and do not represent the potential for shareholder distribution nor the company’s pristine balance sheet position.

Business Overview and History

ScS Group plc, or ScS, is a U.K-based home furniture retailer with 98 stores across the country. It addresses middle to lower-income consumers, with the majority of purchases being made on interest-free credit. Nearly all of ScS’s furniture sales are made-to-order, and delivered after passing through one of the nine distribution centers it operates across the U.K.

Around 80% of its sales come from in-store furniture, with the remainder split equally between in-store flooring sales and overall online sales. The latter channel has been growing moderately, from 3% of gross sales in FY2017 to 9% in FY2022, with a Covid-related spike of 15% of sales in FY2021.

The company sells its own brands such as Endurance and Inspire but also third-party products with the likes of La-Z-Boy and G Plan.

The company is a staple of home furniture in the Midlands, Yorkshire and the Humber, the North West, and in southern Scotland; and it enjoys a 5-star Trustpilot rating over hundreds of thousands of reviews.

ScS’s website. Source: scs.co.uk

ScS was founded in 1894 in Sunderland, U.K. It was a family-run business for some time. In 1993, in began expanding across the country, operating 95 stores in 2007 following a 1997 IPO.

ScS went into administration in 2008 after its suppliers and the company itself suffered from solvency and liquidity issues. We will see ScS’s operating model in detail further below, but for now keep in mind that it runs a negative working capital model, paying its suppliers up to 2 months after a product was shipped to its distribution warehouses; while receiving down payments right after a sale from customers who do not use financing options.

Its suppliers were thus unable to provide products, some even closed down. The company’s credit line, which was unsecured at the time, was withdrawn. Shortly after these events ScS went into administration. Private equity firm Sun Capital provided £20m in capital for a 90% equity stake, and the firm returned to operations.

Since then, CEO David Knight stepped down following an uninterrupted tenure from 2002 to 2021 but still has a 4% stake in the firm. Sun Capital Partners exited their 40% position between late 2019 and mid-2020 following a new listing in 2015.

From 2017 to 2019 the company had plans to expand its stores and add over a dozen locations, but none of it materialized. It also launched a partnership with retailer House of Fraser in the mid 2010s, having its own stands in 27 different locations. The partnership was terminated in 2019, after the results were deemed unsatisfactory and HoF temporarily went under administration. While this led to a 6% drop in sales for that fiscal year, it actually increased EBITDA margins given that House of Fraser operations barely broke even on such a basis.

Given the little relevance of its online channel, the Covid pandemic hit sales hard in 2020: a 20% decline. The company swung to a slight net loss, a £7 million loss when excluding government aid, but kept free cash flow positive thanks to a major decrease in net working capital which we will break down further below.

FY2021 saw a bumper year for the firm and a 20% increase in sales thanks to a favorable macroeconomic environment and a spike in consumer spending, especially in house refurbishment. FY2022 was more nuanced, with a booming first half tainted by a second half that saw the start of the Ukraine war and spiraling inflation.

ScS still operates with a negative working capital model today but has a far greater look into the financial health of its suppliers, and it now has a £12m committed credit line.

On the customer side, the majority of purchases are made through consumer loans, using finance houses that partner with ScS. These loans are interest-free. ScS pays a fee to these finance houses, which, along with warranties, is the difference between gross sales and sales. Sales are 95% to 96% of gross sales each year.

ScS’s 0% APR option. Source: scs.co.uk

Throughout its recent history since the 2015 second IPO, the company has followed a minority shareholder-friendly policy, while having checks in place such as a 1.25 to 2x dividend coverage rule. Dividend yields have ranged from 4.5 to 9% excluding FY2020 and the company occasionally conducted share buybacks, including 6.5% of its market cap between March and November 2022. Stock-based compensation is very low, at around 0.2% of sales with a maximum of 0.5% in FY 2021, so buybacks are not just used to offset dilution. The company has held no secondary offering. Finally, over half of management remuneration is linked to a long term incentive plan paid out in shares, measured by EPS results, aligning management with clear shareholder incentives. Yet, executives hold less than 1% of total shares.

Along with such shareholder policies, the company has a conservative balance sheet, with a £71m net cash balance, no debt, and a 1.7x current ratio.

Macroeconomic conditions and shareholders

Today’s macroeconomic environment seems poor for ScS: inflation is ravaging most parts of the economy and the U.K will enter a slight recession in 2023. Consumer confidence has collapsed from 2021.

GfK consumer confidence barometer for December 2022. Source: GfK

However, consumer confidence seems to have bottomed in September, with the index now up 7 points since then. Furthermore, the major purchase index has increased more quickly and was up 4 points in December alone, although the effects of holiday purchases must be accounted for. Still, the overall index and the major purchase index are both down 27 and 28 points respectively from December 2021.

Globaldata expects the U.K furniture market to drop by 2.3% in 2022, and the U.K flooring market by 0.6%. This shows the resilience of consumer staples businesses during recessions, even when accounting for pull-forward demand in 2020 and 2021 house refurbishment and remodeling. ScS initially saw a steep (14%) like-for-like intake growth for the first weeks of its FY2023, but in the later weeks of October and November that number actually increased by 1.3% from the previous year.

The future path of inflation is a hot debate that we will not dive into here. However, U.K inflation seems to be at least stabilizing. Whether it quickly dives back down or not is debatable, but it is unlikely to suffer more substantial growth.

U.K inflation rate. Source: Tradingeconomics, Office for National Statistics

Inflation data has a direct link with interest rates, with a current terminal rate consensus for the BoE around 4.5%. While inflation impacts ScS’s valuation in a number of ways, one to keep in mind is its aforementioned use of interest-free credit. The higher the interest rates, the higher the cost for ScS to provide these 0% rates with its finance houses partners. It still offers these loans today.

ScS has an interesting group of shareholders:

Tellworth Investments & Bennbridge: 18.2%. The former is a boutique fund owned by the latter. TI is a shareholder since FY2020 and it has been increasing its stake since, and Bennbridge acquired a 6.5% stake in 2022. TI is an activist firm, mainly for ESG purposes but also for general shareholder activity.

M&G Investments: 12.8%. It has had a rather similar stake since 2020.

Hutington Management: 11.7%. An American hedge fund that had a 3-4% stake since FY2019 but increased it drastically in FY2022.

Artemis IM: 11%. Since 2017, the fund’s stake has been rather steady.

Stadium Capital Management: 5.1%

Scion Asset Management: 4.8%. This is in fact Dr. Michael J. Burry’s fund, known for shorting the U.S housing market during the GFC. It has had a similar stake in the firm for the past 3 years. However, this could be dated information and the fund’s stake does not appear in ScS’s latest annual report. Such information is not available in 13-f filings as they only require U.S investments to be disclosed.

At a smaller 4.3% in 8th place comes David Knight, former CEO of the company for nearly 20 years starting in 2002, replaced today by Steve Carson.

Scion AM’s stake is not verifiable enough so we will not consider it in our investment thesis. However Tellworth Investments/Bennbridge’s stake and Hutington’s stake are interesting. TI being an activist fund and Hutington being a hedge fund, their 30% combined stake could give them some weight to make sure shareholder returns are distributed.

Management unfortunately owns very little of the company, under 1%.

Valuation

ScS’s value comes in three parts:

A strong net cash balance

A minority shareholder-friendly policy

Future free cash flows

What’s more, the equity value of ScS does not hinge on a quick return to “normal”. Many valuations today, especially for growth stocks, require central banks to initiate rate cuts by late 2023 at least in order to be justified.

In our model, ScS doesn’t return to FY2022 sales numbers for a decade, nor do its operational margins match the average of the past five years (ex-Covid).

Let’s break down the valuation.

One important element to note is how we treat IFRS16 in our models. Given the nature of ScS’s business, where lease costs account for around 7% of revenue, we compute free cash flow in a pre-IFRS16 manner. We also do this to avoid the bias of lease tenure duration, especially since ScS has been reducing the length of these tenures: it would give an inaccurate picture of the actual net debt position of ScS. On the income statement, IFRS16 is used, including for years prior to 2020 which are restated. On the balance sheet, net debt is computed without including leases. On the cash flow statements, both interest and capital lease payments are considered as operating cash flow, not financing cash flow, including for years prior to 2020 which are restated.

First, a strong net cash balance. This one is rather straightforward, but for the past five years the company has maintained a strong balance sheet, including a net cash position when excluding leases. The company has a conservative use of cash, does not use any debt - but still has a £12m committed credit line just in case - and does not call on capital markets. This is thanks to an operating model that allows it to generate substantial free cash flow, often over 100% of net profits.

The company has often traded at a market cap to net cash ratio of just over 100%, reaching a peak of 180% in 2018. Today, it trades at around 80% net cash after the 2022 stock market rout.

It is important to note however, that in that cash pile are included £25.5m of customer deposits. Thus, net cash from a valuation standpoint could be valued at a much lower £45m.

Then, a friendly minority shareholder return policy. The aforementioned net cash would be useless to minority shareholders if such a policy was not in place. A typical case of a value trap is a company with loads of cash sitting in its balance sheet, but no minority shareholder return policy. Many analysts go through of phase of looking at Japanese equities, thinking they have found an El Dorado of value investments, only to see their investments stagnate or even drop in value over the following years as cash is never distributed to minority stakes.

ScS however, has a great track record of good policies and will continue to exercise them in the future. Total shareholder returns, i.e dividend + buyback yields, have often been above 8% a year. In its November 2022 general assembly, the firm proposed an attractive final dividend for the past fiscal year - which has been paid out already - despite rocky market conditions. For the coming fiscal year, it has said it will abide by its shareholder return policy, which includes several hurdles, with the most restrictive one being a 1.25 to 2x dividend coverage ratio. With that in mind, and assuming a 75% drop in net profit for FY2023 as well as the stricter 2x coverage ratio, the company should provide a 2.5% dividend yield for the upcoming fiscal year. If it were to be more lenient and use a 1.25x ratio, and profits were to fall by “only” 50% which is still below analyst consensus, the company would be providing a 9.7% dividend yield.

But let’s remain conservative. The more attractive element of the shareholder returns for the upcoming year are buybacks. In the November assembly, shareholders approved a £3.1m buyback and cancellation program, i.e around 6% of the market cap at that time. Such buybacks can often be approved but not necessarily executed, yet ScS already went through most of its previous share buyback program earlier in the year. What’s interesting is that since the approval of those buybacks in November, the company has already repurchased nearly £1m of its own shares. In the past couple of weeks, it has sometimes been maxing out its daily number of authorized purchases. The company thus seems well on track to fully complete its buyback program. With a little over £2m in buybacks remaining and given its current market cap, shareholders can expect a 4% buyback return over the coming months.

This gives shareholders a combined conservative return of 6.5%, before any capital appreciation. As mentioned previously, these returns will not be offset by dilution from share issuance, as stock-based compensation is negligible at ScS.

Daily share repurchases in December 2022, absolute and as a % of daily maximum authorized by latest share repurchase plan. Source: ScS corporate website, own analysis

Finally, let us look at future free cash flows.

In late November, ScS announced that like-for-like (LFL) order intake had dropped by (9.1%) between August 1st and November 19th. LFL order intake growth was actually down (14.4%) in the first 10 weeks following August 1st, but is now up 1.3% between early October and mid-November. While previous year comparatives help explain those swings, this data also suggests that a 10% drop in revenue for the entire FY2023 seems like a plausible, albeit conservative, scenario. In our conservative view, we expect a second drop in sales in FY2024, around 3%. We then expect growth in line with the U.K economy at around 2% until 2028 and onwards, at just 1%, including terminal value. It is important to note that over the past five years, ScS’s revenue stagnation with £333m in FY2017 sales and £332m in FY2022 sales is due to the end of the House of Fraser partnership and a sales drop during Covid lockdowns, so positive growth should be expected in the future. All these numbers are at nominal value, thus 2023, real sales could conservatively drop by (15%). ScS does not disclose profitability per sales segment - in-store furniture, in-store flooring, and online - so this breakdown will not be accounted for in the rest of this analysis.

We can also expect a slight drop in gross profit margins and a return closer to the mean than in the previous years, at around 46.8%. This drop will likely be due to shipping costs from their suppliers, and slashing prices to offset some of the inventory the company has on hand. This drop of only 300 bps is limited due to company’s made-to-order model. The company orders products and ships them to customers roughly 5 weeks after they have shopped for them online or seen them in stores, which the company adequately calls “showrooms”. This means that ScS has little inventory on hand at all times, which keeps inventory as a % of sales at 6-7% consistently every year, even during FY2020. Thus, ScS won’t have to offload massive amounts of inventory at lower margins conversely to other retailers in the previous months. We expect this level of gross margins to be sustained over the following years, although this is a conservative as gross profit margins have been over 47% (ex-Covid) since the end of the House of Fraser partnership.

On the expenses side, SG&A costs as a % of sales has come down over the years, thanks to cost control, lower employee headcount, and the closure of a couple of showrooms. Today, they represent 34.6% of sales. Distribution costs have increased in recent years, going from 5% to 6.4% of sales between FY2017 and FY2022. This is due to the opening of new distribution centers and higher driver wages.

Among those expenses, wages, heating and lighting can be of interest given the current environment. Wages represent about half of SG&A, and while they have sometimes been increased, they have mostly been in line with revenue growth. The company discloses the costs of heating and lighting but also includes the cost of rates in its disclosures. Hence, the maximum amount that heating and lighting represent is around 6% of sales. A 10 to 15% increase of these two cost centers would not be too negative on the bottom line. More importantly, the company does not actually use any gas in its operations. It had been conducting energy transition efforts over the previous years, and now runs with 100% renewable energy. This means that, apart from costs that suppliers could pass down on the company, ScS is largely shielded from increases in natural gas costs. We conservatively estimate each of those costs to slightly increase and, along with a drop in gross margins, bring EBITDA margins down to 11.5%, from 14.1% in FY2022. We also model EBITDA margins remaining below their past 5 year-average of 14.2%, at around 12.5% to 13% for the following years, including 13% for terminal value; and 4% for EBIT which was the average margin over the three years pre-Covid and partly included the House of Fraser lower margins.

U.K day ahead gas prices in late 2021 and 2022. Source: Catalyst Commercial

80% of D&A costs come from rent costs, which have actually gone down in previous years, of course while adjusting for IFRS16 pre-2020. We expect D&A to remain stable as a % of revenue over the coming years.

ScS notably generates substantial operating margins through near 30% ROIC and ROE over 25%, mainly since it uses no debt in the case of ROIC.

The company has no debt, and we model the upcoming increase of the U.K corporate tax rate from 19% to 25% for ScS’s FY2024 and onwards.

Perhaps the most notable, and maybe misunderstood, element of ScS’s FCF is the change in net working capital, or NWC. One would believe it to be heavily impacted by inventory swings, but as we have seen previously, the company’s business model prevents this. However, it’s all about payables, and to a significantly smaller degree, receivables.

This is how ScS describes its working capital model:

“For cash/card sales, customers pay deposits at the point of order and settle outstanding balances before delivery;

For consumer credit sales, the loan provider pays ScS within two working days of delivery;

The majority of product suppliers are paid at the end of the month following the month of delivery into the distribution centres.”

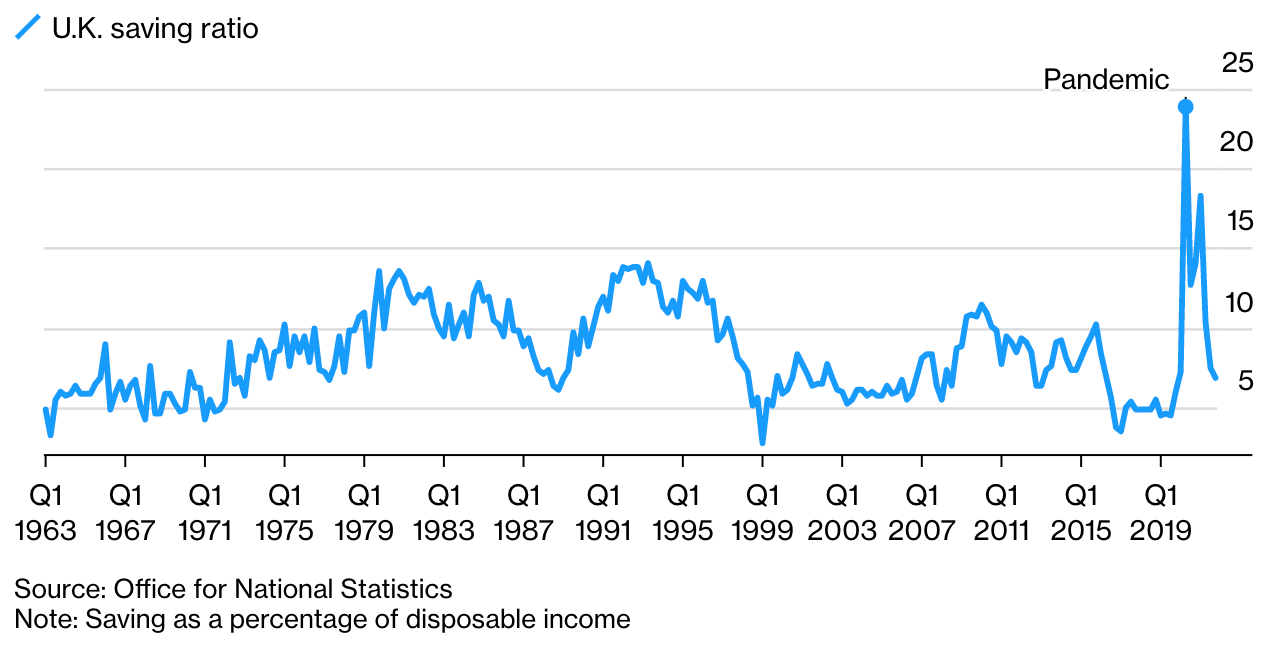

Most of the NWC large swings have been from the payables line “Payments received on account”, meaning “deposits taken from customers at the point of order and in advance of the Group fulfilling its performance obligations to provide goods and services for customer orders”. Remember, usually the majority of purchases are done through consumer credit loans, handled by 3rd parties. Yet during the first Covid lockdowns, savings rates across Western countries including the U.K skyrocketed.

U.K saving ratio as a % of disposable income. Source: Bloomberg

From 5% to a nearly 25% saving ratio, this unprecedented increase gave ScS’s consumers the ability to pay with cash or credit, instead of through a loan. As this occurred, payments received on account spiked, which generated £27m of the £35m in FCF for FY2020. Since then however, consumer lending has ticked back up: first in 2021 as interest rates bottomed and money was flowing in the economy, then in 2022 as times got much harder for U.K households and they had to resort to consumer lending.

Average 12 month growth rate for the calendar year of total (excluding the Student Loans Company) sterling net consumer credit lending to individuals (in percent), seasonally adjusted. Source: Bank of England, ScS 2022 Annual Report.

As we have just seen, when consumers use loans from finance houses that partner with ScS, it does little to the company’s balance sheet. No payables are recorded since there is no downpayment, and accounts receivable increase for only about a couple of days between the moment of delivery and the loan house paying ScS. Thus, change in net working capital has been highly positive in the past couple of years, leading it to reduce FCF substantially.

Now that we understand the firm’s NWC system, what lies ahead for ScS? Consumer lending should continue to increase, therefore we have modeled a £10m negative impact on FCF for FY2023, bringing FCF to (£12m). Given the unusual occurrence from the Covid savings spike and ScS’s inventory management, we then expect changes in NWC to be neutral from FY2024 and onwards.

Please remember that interest and capital lease payments are included in cash flow from operations in our models.

CapEx is small at ScS, hovering around 1% of revenue.

Finally, the future value of cash flows is discounted with a 13.5% discount rate, and its terminal growth value is only at 1%. In all transparency, using the CAPM, the WACC should stand at 8%. This is considering a 4.75% terminal rate from the BoE, an 0.8 beta for ScS, and an expected market return of 9%, i.e the average S&P500 return in previous decades. Yet we decided to tag on an over 50% increase as:

the CAPM and WACC models are always debatable and far from an exact science

a margin of safety is implemented

Given that we do not consider leases as debt, the cost of debt was not included here since there is not debt. However leases are an important element of ScS’s cost of capital. If leases were included, the WACC would be even lower than 8%, given ScS pays around 2-3% interest on lease liabilities.

In the end, our model provides us with a 75% upside for the company for an equity value just over £100m, and a per share price of 282 GBX. This number should be put into perspective however: 70% of that value comes from the net cash balance, and only 30% from discounted future cash flows. And remember, if we want to truly be conservative, £25.5m of that net cash pile is from customer deposits. When removing that number from net debt, our model provides only a 32% upside.

It is worth mentioning that in its presentation of 2022 results, ScS announced that its net cash pile… increased to £77m from £71m in the previous quarter, despite intense buybacks and some difficult trading weeks.

For anyone wondering, if IFRS16 were to be used for the valuation, although the company would now have a net debt of (£36m), the exclusion of the capital element of leases payments, around £25m per year, from the operating cash flow creates a massive equity value of £196m. We do not believe this to be an accurate representation of the value of the business.

Our £100m is also close to ScS’s £109m liquidation value, and worth twice its £50m book value. Today, the company trades at just 1.1x book value.

Finally, this 75% upside is on top of the highly likely 2.5% shareholder return in dividend and buybacks that could reach 13.7% in a less conservative and more optimistic scenario.

Risks

Of course, an investment in ScS is not without risks.

The most obvious ones would be an aggravated recession and a prolonged highly inflationary environment. While ScS can sustain high interest rates, inflation and a mild recession, the last major one in 2008 brought the company down. Lots has been changed since, notably the relationship with suppliers, but there are no guarantees.

Shareholder returns are an important part of the investment thesis, as they could provide over 13% returns over the next year. If management were to withhold these or severely limit them for any reason, such as fear of a worsening macro environment, than the investment becomes substantially less compelling.

ScS models different types of scenarios in case macro conditions were to change one way or another. Its worst case scenario that it calls “severe but plausible” has the company going through a low cash point of £34.5m, after withdrawal of supplier credit insurance, as well as gross margins severely reduced for two years then flat afterwards. On a positive note, this means the company still expects to have almost 50% of the current cash balance in a bleak scenario. Yet the obvious negative here along with the lower gross margins would be the impact to the valuations. Net cash represents 70% of the firm’s value in our DCF model, thus in such a scenario the upside shrinks to around 10-15%, before accounting for lower gross margins which brings the company’s forecasted value down to its current market capitalization.

Some may worry about U.K furniture retailers’ health following Made.com’s fall into administration in Q4 of last year. Keep in mind that the companies’ business models differ quite substantially, especially regarding shipping costs and the use of online channels. In the latest comparable period, six months to June 2021, Made.com’s fulfillment costs accounted for 19.6% of revenue, so an increase in supply chain costs and lead times led to its downfall. For ScS, that number was at 5.6%. Even during the boom of online sales during lockdowns, Made.com reported losses. ScS is a more mature business, with growth being only a small part of the business plan and profitability being key, whereas Made.com was running a growth-at-all costs model.

There are little ESG risks as the company now has a 100% renewable footprint, often reviews work contracts with employees and has roughly equal gender representation at Board and management level for instance. In terms of output, the company produces furniture products which are far from controversial. The only potential material risk would be on the supplier side, since the furniture is made in the U.K but uses parts from around the world, notably Asia. The origins of some parts could be revealed to be unethical, despite ScS pledging to have a certain look on the entirety of the supply chain. In any case, a further deep-dive on ESG risks is required to have a clearer picture here, but this was not the central focus of this publication.

Finally, what is perhaps more of a downside than a risk is the firm’s size. ScS is a so-called micro cap, and many institutional funds do not invest in such companies. It also means that price discovery can be slow, while intense price swings can occur with little volume required.

Conclusion

ScS is a value pick with a high margin of safety. The company seems poised to provide a minimum of 6.5% in shareholder returns through dividends and buybacks, while its future cash flows and more importantly its net debt position justify a 75% upside.

It is down 50% from its highs for a wide range of factors, most of them linked to inflation and recession fears. Yet, its business model is sound and allows its inventory to withstand quick changes in demand. It generates free cash flow almost every year, is profitable through high ROIC and ROE, and does not have any debt.

Even while using pessimistic earnings predictions, the company still trades at too much of a discount relative to its future cash positions and distribution policies, with its current value at around 80% of net cash.

DFS Furniture is ScS’s closest peer. I do not have an opinion on the company, and it also offers a high dividend yield and started doing buybacks recently. It too operates through a made-to-order model. One of the biggest differences with ScS is the valuation, as it is much more expensive in terms of multiples and net debt accounts for 20% of enterprise value. Diving deeper into DFS could be interesting.

There are some risks with ScS of course, with perhaps the biggest one being supplier risk, especially when looking at the company’s downfall in 2008. But its situation has changed since then, and the company has implemented safeguards.

Disclaimer: I, the author, do not hold shares in ScS Group plc as of the publishing of this article on January 2nd, 2023. The contents of this article do not constitute financial advice, please conduct your own due diligence.

All views expressed in this post are my own and my own only, and not represent those of any other person or entity.

Great analysis, thanks for this write up! What are your thoughts about the use of nil cost options as part incentives for senior mgmt?

Hi, Some of the cash is customer advance deposit held by SCS for orders. If customer decide to cancel the order then the cash should be returned back. So the actual numbers could be misleading.