Rocket Lab | SpaceX's discreet little brother

Kiwis, You Only Live Twice, and Information Mismatch

James Bond films aren’t known for their historical and technical accuracies. Yet, when screenplay writer Roald Dahl and director Lewis Gilbert worked on You Only Live Twice, they designed a rocket that would become reality over 50 years later. In the movie, that almost completely deviates from the book, a mysterious spacecraft captures American and Soviet spacecrafts by eating them up like the Kraken.

In 2021, smallsat launch company Rocket Lab’s founder and CEO, Peter Beck, unveiled concepts for Neutron, their next rocket to fly to orbit. The resemblance in their uniqueness is quite staggering, and a beautiful throwback to an age where Man had yet to set foot on the moon.

Montage, with: Top: Rocket Lab’s upcoming Neutron rocket; Bottom: Scene from You Only Live Twice. Source: Rocket Lab, Eon Productions.

Of course, it is not this funny coincidence that compelled me to write this lengthy publication. My apologies in advance, this one is considerably longer than usual, but I thought it would be an opportunity to use my joker card.

I wanted to write this article to give anyone that is interested a perspective on investing in space, more specifically the Small Lift Launch Vehicle industry, or SLLV. Space does not bode well with equity returns sought by Wall Street at first glance: long development cycles, capital intensive, binary risk/failure events for launches, etc. Yet, SLLV companies are a novelty in today’s market, with three going public last year, and certainly more to come. This means that the likelihood of inaccurate valuations is higher than usual, and thus yields interesting opportunities.

In fact, I believe that valuations of SLLV companies should be largely qualitative, not quantitative. This lack of standardized data for algorithms and quants gives industry insiders a significant advantage over others. Before working in finance, I spent some time in the aerospace world, first working for Arianespace’s sister company ArianeGroup, then at space consulting firm Euroconsult.

During that time, Rocket Lab was continuously on my radar. It is a company that has consistently delivered, is moving faster than its peers, has an excellent track record, and is setting itself up perfectly for the years to come. Today is an interesting day to deep dive into the smallsat launch industry and Rocket Lab itself. This Sunday, it will attempt a rocket first-stage capture with a helicopter, which would be a major milestone towards reusability, the crown jewel of launch vehicles.

Let’s have a look, and I promise: there won’t be any rocket emojis or ‘to the moon’ references at any time.

Threads and other finance-related tweets @AlaricsPicks

Executive Summary

Rocket Lab is an end-to-end smallsat launch company founded in 2006 by CEO and CTO Peter Beck. Its Bloomberg ticker is RKLB:US.

Today, Rocket Lab is positioning itself as the leader among small lift launch vehicles – SSLV – startups. The smallsat industry is set to grow at 14% CAGR until 2029 to reach over $50 billion. A global sell-off in tech equities has hammered the company’s market capitalization, down over 60% from its all-time high less than a year ago. Yet, the value it sits at today gives the company a fair valuation at worst, an undervalued one at best, thanks to:

An excellent legacy and track record, the golden currency in the space launch industry. With a success rate of 88% and 22 successful missions, Rocket Lab is far ahead of its startup peers. It remains tiny compared to SpaceX, but these companies rarely compete for the same customers.

A competitive rocket in Electron, not just in terms of pricing but also on the end-to-end services it offers: fast launch, satellite design and components, etc.

Exceptional use of capital, having accomplished much more than its competitors with less money raised: shorter development times, quicker successes on launch, better business development, etc.

An excellent CEO in Peter Beck, that has been fully invested in the company for 15 years, that still holds a 12% stake in it, and that is always very transparent in the communication of the technicalities of Rocket Lab’s engineering projects.

A strong pipeline, in terms of backlog, USD 545m, and of future projects with the development of the medium-class launcher Neutron and the growth of its space systems division.

A better offering than most of its competitors, as well as early mover advantage.

Poor valuation made by markets participants, which value Rocket Lab only 4x higher than competitors who have yet to generate revenue or build a track record. The use of financial data can only get analysts so far, and true edge will be found in qualitative analysis, which shows that Rocket Lab is undervalued when compared to peers at least.

While it is almost a VC investment, short-term catalysts could include a successful catch of the first stage part of a rocket this Sunday, a quick push into reusability which would significantly expand gross margins, and a successful CAPSTONE moon mission with NASA.

Price target: $8.3 – should be revised often due to early nature of the investment.

Upside: 14%

The SmallSat Manufacturing & Launch Market

Space is hard. You probably won’t go a day working in an aerospace firm without hearing that famous motto. Over the past decade, the commercialization of space has accelerated exponentially. Yet, dozens of companies still go bankrupt every year in this environment that’s as unforgiving as what’s above the Kármán line. In this do or die industry, execution and efficient use of capital is key.

The smallsat manufacturing and launch (SM&L) market has been perhaps the biggest driving force of the space sector’s growth in recent years. Small satellites, or smallsats, are satellites with a mass below 500 kg, although definitions vary – NASA defines smallsats as being below 180 kg, but this is not widely used. The SM&L market was worth $14 billion in 2019 according to Euroconsult. The amount of smallsats launched went from around 20 in 2010 to 385 in 2019, but that number is also impacted by smallsats themselves becoming smaller. The decade to come will be even more explosive for that market.

For a quick refresher, the space industry has seen a major shift over the past decade. Very broadly, from the 1970s to the early 2010s, the industry was dominated by only a handful of players, mainly satellite manufacturers, operators, and launch providers. The bigger players got even bigger in the 1980s through a wave of M&A, especially in the U.S where three majors ended up dominating the industry: Boeing, Lockheed Martin and Raytheon Technologies. The fall of the USSR and the end of the Cold War in the early 1990s led to a steep drop in demand, as Russian military satellites had previously accounted for half the demand, followed by Russian civilian satellites and U.S military and civilian satellites. The burst of the IT bubble in the early 2000s put a quick end to a surging demand for commercial spacecrafts.

Source: ‘War in Space – Strategy, Spacepower, Geopolitics’ by Bleddyn E. Bowen

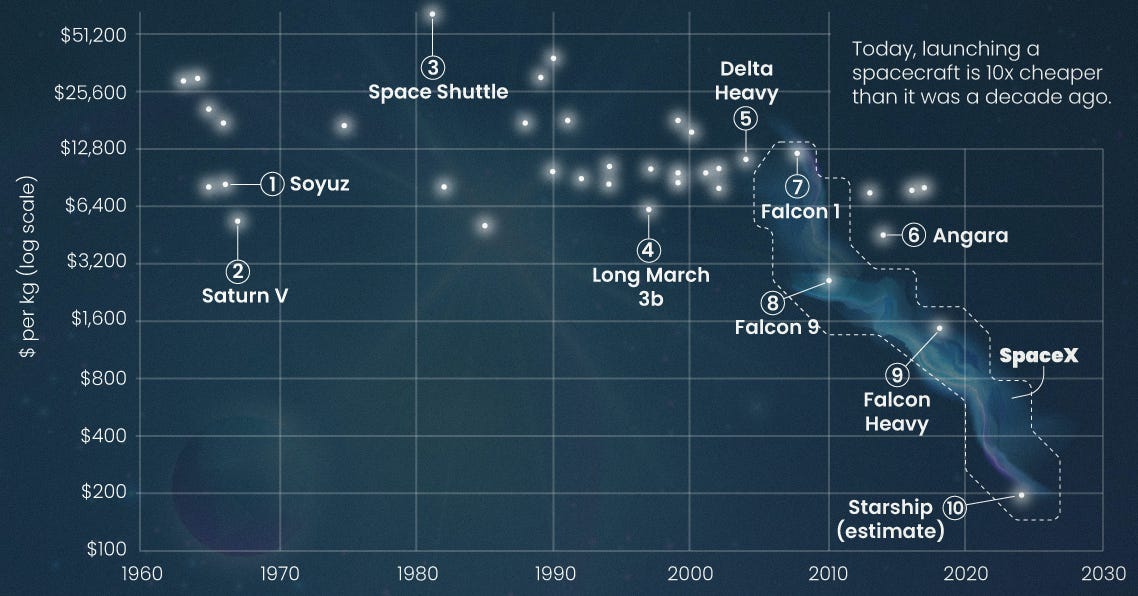

Since the early 2010s however, the satellite manufacturing and launch market has seen a major resurgence. This is due to a surging demand in broadband and data analytics, and a spectacular drop in launch prices, to LEO at least, led by SpaceX. LEO means Low Earth Orbit, i.e orbits below an altitude of 2,000 km. Until the past decade, satellites were much heavier, with an average mass of over 1,000 kg against around 60 kg today, and they were much bigger. They were often placed in higher orbits than LEO, with one of the most popular one being GSO, located at an altitude of c.36,000 km, famous for orbiting the Earth at the same speed as our planet, which gives them a consistent position over a single longitude. Today, LEO demand dominates the industry.

Evolution of the cost per kg for a launch in LEO. Source: Visual Capitalist

Both government and commercial demand have increased, leading to government demand still accounting for over 75% of the satellite launch and manufacturing market. Today, academia accounts for about 20% of satellites launched per year, however in terms of revenue its share is almost negligible, at low single digits.

Where Rocket Lab comes in

Rocket Lab operates in what is called the smallsat market, as well as the small lift launch vehicle market. The company provides satellite manufacturing services and launch services.

One immediate question one may have when looking at SLLV is: why do they even exist? SLLV have a higher cost per kg than bigger rockets due to scaling differences, often 4x more expensive, so why pay more instead of bundling up with other smaller satellites in a bigger rocket, i.e a rideshare? Dedicated launches have a series of benefits:

Time: By being the exclusive customer, the satellite operator can make sure that the launch happens as soon as they are ready. There is no obligation to wait for other customers, especially the highest paying one. In the same vein, if the satellite operator is late due to its own internal issues, then there is no waiting issue for the other non-existent customers. Basically, it’s a taxi vs. a bus, or a private jet vs. a commercial airliner.

Cash burn: as a direct consequence of the time aspect, satellite operators can avoid severe cash burns. Most of the costs of a satellite project come before the launch, after which only operating costs are still at play, leading to high margins post-launch. According to VC firm Space Capital and SpaceX, in 2018 the average duration from contract signature to launch for a SLLV was 15 months, against 24 months for a heavy launch vehicle, and SLLV have increased their frequency significantly since then. And according to Rocket Lab themselves, more than 50% of small satellites launched between 2016 and 2021 were delayed from 4 months to 2 years. Any income that a satellite operator generates comes from exploiting the satellite’s data, so for instance a one-month delay, which is far from rare, would see the annual revenue of a start-up launching its first operational satellite drop by around 10%.

Technological constraints: without getting too much into details, each satellite has its own constraints. As an example, if the lead customer on a rideshare mission tells the launch provider that it can withstand certain frequencies of vibrations during lift-off, then the provider will not seek to reduce those vibrations, and that may just make it incompatible with the capacity of the smaller operator’s satellites.

Exact orbit: In rideshare launches, the launch provider drops off the main satellite very close or at its orbit, while the rest of the customers need to reach the ‘last mile’ to their exact orbit on their own. To reach orbit, the satellite will have to use its propellant reserves, which reduces its useful life since satellites in LEO need to reposition themselves every now and then to maintain their orbit. Adding insult to injury is the time wasted to get to that orbit, which can easily take months given the tiny thrust the satellite’s engines have. Again, more revenue is lost.

All in all, customers of launch vehicles do not think purely in terms of cost per kg advertised on a rocket, they want this holistic question answered: ‘How do I get X mass to Y orbit in Z timeframe, and what’s the lowest cost that I can do that for?’

TAAM: Total Actually Addressable Market

TAMs get a bad reputation due to pitches always throwing astronomical numbers around. Let’s try to get an actual accurate representation that isn’t a trillion dollars.

The SM&L market value is set to rocket – no pun intended – to $51 billion by 2029 according to Euroconsult, at a c.14% CAGR, with an average of around 1,000 satellites launched per year, up from an average of 181 during the previous decade. Now of course, these are broad numbers, Rocket Lab does not have nor does it plan on having the capacity to address all of it, despite claims of a trillion+ market by 2030 seen in flashy investor presentations from space companies including Rocket Lab.

Of the $51 billion, $33 billion – 65% – is slated to be in smallsat manufacturing, and $18 billion – 35% – in smallsat launching. As we will see below, Rocket Lab is an end-to-end space company, seeking to provide both launch, satellite manufacturing and data handling services, and it already provides the first two of these three services. It can thus address both sides of the SM&L industry. Yet, the $51 billion is a number across the world. 75% of Rocket Lab’s revenue over the past two years have come from U.S customers, the rest coming from Japan and Germany. Regarding the market as a whole, the 3 biggest regions in terms of where the SM&L operators are located are:

North America: $21 billion

Asia: $16 billion

Europe: $5 billion

All of North America can be included in Rocket Lab’s TAM, yet about three quarters of Asia’s market can be removed due to China’s weight in it. Chinese customers are extremely unlikely to come on board due to regulatory issues especially when working for the U.S government. Due to other national preferences as well, especially with its own excellent PSLV rocket and the upcoming SSLV rocket which would be very competitive for smallsats, the Indian government is unlikely to join. Over half of the European market can be removed too for national preferences and other security concerns. That leaves Rocket Lab with an addressable market of around $27 billion.

There is still more dilution to be done due to mega constellations. These constellations are comprised of thousands of satellites in Very Low Earth Orbit or Low Earth Orbit – LEO. The main three are SpaceX’s Starlink, Amazon’s Kuiper, and OneWeb. The latter has seen some trouble, going bankrupt a couple years ago but being recently brought back to life. Starlink and Kuiper will account for over half of planned smallsat launches in the next decade, yet will account for only 1/5th of the SM&L market in dollar terms according to Euroconsult. Rocket Lab will not see any revenue from Starlink as SpaceX has and will continue to handle all manufacturing and launch; and is unlikely to land Kuiper contracts until at least the end of the decade when it could have bigger launch capacities. Thus, at least a 20% discount should be applied to our $27 billion addressable market, reducing it to around $21 billion.

Therefore, Rocket Lab will have to compete with several established players such as SpaceX and its rideshare capabilities, as well as startups in a booming and competitive small launch environment, in the hopes of grabbing a piece of the $21 billion pie in 2029.

It should be noted however that 16% of all smallsat launch missions – mega constellations included – are expected to be for single satellite missions, which by definition means there is no threat from rideshare companies. Since the cost of single satellite launches are always more expensive that their counterparts, then at least 16% of the $27 billion computed earlier, or $4.3 billion, should be reserved for dedicated smallsat launch providers, of which Rocket Lab is becoming a leader. So, out of the $21 billion addressable market by 2029, $4.3 billion will be easier to obtain than the rest. Still, the dedicated smallsat launch market competition is ramping up, as we will see later.

Applying the same computations, bar the ‘mega constellation discount’, we end up with a $7.4 billion TAM for Rocket Lab in 2019, and $10.1 billion today. Over the next decade, the TAM evolves as follows:

One final element is the space applications wild card. Rocket Lab’s strategy includes entering the space applications market that is already worth over $300 billion today, 95% of which coming from satcom, navigation and earth observation. While I have little doubts regarding Rocket Lab’s earnestness on the matter, there is too little visibility for now to accurately compute Rocket Lab’s potential TAM in this sub-industry, as the company has not provided such services for now and has communicated few plans to do so in the near-future. One should, however, stay on the lookout for any updates.

Business Overview

Rocket Lab is an end-to-end space company founded in 2006 by Peter Beck, who is still CEO and CTO today. It was founded in New Zealand but is incorporated in the U.S to be eligible for U.S government contracts, with headquarters located in Long Beach, California. Rocket Lab now has around 1,200 employees, up from 500 three years ago.

The company provides launch services and space systems services, which is also how it segments its revenue:

Launch Services: Provides launch services to a or several customers on a dedicated mission or a rideshare mission.

Space Systems: Space engineering and program management, mission operations, spacecraft manufacturing, sale of spacecraft components.

The revenue split between these segments varies significantly between quarters due to Rocket Lab’s revenue recognition accounting. Launch services recognizes revenue mostly through a point-in-time system since the company gets paid almost entirely only once the launch mission is successful, whereas spacecraft building and other such operations have an over-time model.

Rocket Lab’s customers are the U.S government and commercial actors. Concentration widely varies between years, with no specific reliance on the U.S government or a commercial actor. For instance, in 2020, 21% of revenue came from one U.S government contract, whereas no U.S government contract exceeded 10% of revenue in 2021. U.S government customers include NASA, the U.S Space Force, NOAA, DARPA, and the NRO. Commercial customers are either building small constellations such as BlackSky, or requiring the occasional launch.

Launch Services

For its launch services, Rocket Lab uses its launch workhorse: Electron. It is a SLLV capable of carrying 300 kg to LEO and 200 kg to SSO – sun-synchronous orbit, also an LEO but at an inclination that requires more capacity from the rocket. It is 18 meters in height, and 1.2 meters in diameter. The rocket has two stages and a third stage, known as a kick stage and called Photon, that places payloads into the exact orbit required. Electron’s body is mainly made of carbon composite, a very lightweight material but also a more expensive one than most of its counterparts such as stainless steel. It uses nine Rutherford engines, an in-house engine that is almost entirely 3D printed to reduce costs and odds of engine failures since it avoids using thousands of parts. I won’t get into the specs of the engine to avoid any headaches, but it’s all well described in Electron’s Payload User Guide.

The Electron rocket started being developed in 2013, and flew for the first time in 2017 with a first successful mission in 2018. Note that five years from conception to a functioning prototype is quite short for launch industry standards. As of today, Rocket Lab has completed 25 missions, with 22 of them being successful, putting 112 satellites into orbit. Last year, Electron became the 2nd most launched rocket from an American company, only behind SpaceX’s Falcon 9. Rocket Lab is actively working on making the launcher partly reusable by recuperating the first stage with a parachute and a helicopter. This would significantly bring down costs, not just for material reasons but mainly regarding labor costs – that can be used elsewhere –, logistics, R&D per rocket, and more. An attempt to retrieve a used first stage this way is scheduled for this Sunday.

Electron launches per year. In green: successful launches; in red: failures; in blue: planned launches. Due to a drop in signing of launch agreements during the height of the pandemic in 2020 and a launch failure in 2021, the year 2021 saw a reduced launch cadence.

Electron launches are priced at $7.5m per launch according to Rocket Lab, but revenue per launch can vary regarding specific customer demands. Notably, launch for military and other government institutions will yield higher revenue.

Last year, Rocket Lab announced it had started development of a new launch vehicle: Neutron. The target for first launch is 2024 but given this is an aerospace industry deadline I wouldn’t expect it to fly correctly until 2025. Neutron will be a partly reusable medium-class launch vehicle, capable of lifting 8,000 kg into LEO, and even up to 16,000 kg when in expandable mode.

It will share some similarities with Electron such as a mostly carbon composite body, a domain where Rocket Lab has become a leader in the launch industry over the years. Its payload fairing will be 4.5m wide – keep in mind that size matters for rocket fairings, they are just as much a constraint as payload mass. The first stage will be reusable, along with an innovative fairing system seen in this article’s opening, although my time working for ArianeGroup’s multi-launch systems division has me slightly skeptical on how the fairing will hold. If they do manage however, this will greatly reduce costs as fairings are much more expensive than people think. Neutron is being designed with 24-hour turnaround possibility and low costs in mind. It means it will likely not feature a launch pad – or a very rudimentary one – and be integrated vertically, all of which save cost and time. It will also land on soil, not on a barge, given how expensive a barge is: Peter Beck claimed it costs up to $70,000 a day to lease barge, excluding operational and fuel costs, while an all-inclusive S92 helicopter – used to retrieve Electron – costs $5,000 an hour and needs to be used for less than 10 hours.

Neutron was designed to answer the upcoming growing need for medium to heavy lift launchers for constellations – but again, excluding Starlink and Kuiper demand. It will also do classic rideshare missions as Electron is doing. Ideally, by the time Neutron is active, Rocket Lab will:

Use Neutron for constellation customers or major rideshare missions, and perhaps the occasional heavy satellite in LEO.

Use Electron for dedicated missions, and sometimes rideshare missions for the smaller satellites.

For now, Electron has been launching from New Zealand, at the Mahia Launch Complex that it owns, featuring two launch pads. Rocket Lab is unique in this regard: it negotiated a treaty between the U.S and New Zealand to be able to launch U.S payloads from foreign soil, which is almost unheard of. It owns the Mahia complex, which is also very rare. Launch providers often lease out parts of a launch complex that is run by a government, such as the launch pads at Cape Canaveral in Florida. Rocket Lab can thus run its operations on the timeline it desires, without having to negotiate launch dates with other launch companies – having their own runway instead of an airport HUB essentially.

The company will have to compromise however with Neutron, as it is scheduled to launch only from Wallops, Virginia, at NASA’s MARS complex – Mid-Atlantic Regional Spaceport. They did this for two reasons: less shipping costs and time for U.S satellite manufacturing customers and US government missions, and they are building Neutron on-site to avoid U.S regulation that requires max diameters of 3.7 meters for road cargo – this is why SpaceX’s Falcon 9 is 3.6m in diameter actually – allowing Neutron to have a 7m-wide base, helpful for orbital re-entry.

Rocket Lab’s launchers – top: planned Neutron rocket; bottom: Electron Rocket. Source: Rocket Lab

Space Systems

When Rocket Lab mentions it being an ‘end-to-end’ company, it means it wants to provide not just launch services, but also satellite engineering services. It has already received several large contracts to build satellites for customers, all the latter have to do is provide their payload that Rocket Lab integrates into its standardized Photon payload platform.

This is an enticing offer for some companies: many of them have added value not from the way they build a satellite bus – the ‘skeleton’ of satellite – , but from the payload within the bus and often the data it provides and how it is analyzed. For instance, an Earth observation company that has excellent software to analyze weather patterns and has developed its own high quality camera, does not want to waste time and resources building the satellite that hold the camera in space. So, it would rather pay Rocket Lab to handle the integration into its standardized satellites and focus on what that company does best. This creates a one-stop shop that makes Rocket Lab more than a launch provider. It was recently exemplified with a $143m contract award from MDA to provide satellite buses as well as optional dispenser and integration services.

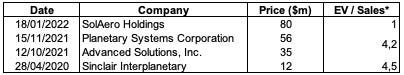

Rocket Lab launched this division in 2019, leading it to go on an acquisition spree over the past couple years. It has acquired 4 companies so far:

*Based on sales estimates for the year of closing

SAH is a supplier of space solar power productions and precision aerospace products, with a 100% reliability rate with its solar cells. PSC is a leader in separation systems, with 100% success for its products on over 100 missions. ASI develops flight software, simulations and GNC systems, Rocket Lab used to be a customer. SI builds smallsat components such as reaction wheels, which allow for spacecraft rotation without the need for thrust engines. All companies are profitable according to pro-forma statements.

Example of how each acquired company can contribute to Rocket Lab’s spacecraft engineering services. Source: Rocket Lab

Growth of the Space Systems division has been exponential since its launch three years ago, already accounting for c.26% of pro-forma 2021 revenue. It has been of course mainly driven by acquisitions, which could continue in the years to come given how much cash Rocket Lab raised with its SPAC merger.

Because yes, I must admit, Rocket Lab is a former SPAC. Special purpose acquisition companies have rightfully received a bad reputation in the past year, with excessive investor promises, major dilution events, and egregious founder share awards. That Rocket Lab went public through a SPAC is a bit disappointing, but also understandable.

The company signed a merger agreement with sponsor VACQ at the peak of the SPAC bubble in early 2021, and then merged in August 2021. From a shareholder’s point of view, it did well, as it allowed the company to float at a high valuation and raise significant cash, with almost no redemptions: $10 out of $320m, against 80% redemptions for Virgin Orbit when the SPAC peak had past. The investor presentation has typical SPAC issues however, making wild claims about TAM and unlevered FCF growth. It is disappointing, but perhaps more reflective of the SPAC sponsor than the way Rocket Lab actually communicates. Its CEO, Peter Beck, is extremely open about tech developments in many interviews, and the company often updates its followers on what’s next. This is in contrast with some legacy aerospace firms that keep things secret. Such transparent communications from Beck generates investor enthusiasm and an increasingly large following, with the golden standard already set by Elon Musk years ago for SpaceX.

Proceeds from the SPAC deal. Source: Rocket Lab 2021 10-K filing

The company is run by founder, President, CEO and CTO Peter Beck, which holds a c.12% stake in the firm. The second in command, Shaun O’Donnell, joined Rocket Lab only several months after it was incorporated. The Board of Directors includes:

Peter Beck, President.

Alexander Slusky, founder and CIO of Vector Capital, the VC firm that created the VACQ SPAC.

Dr. Sven Strohband, MD and CTO of VC firm Khosla Ventures, that generated a 60x return on their early investments in the company and still remain the largest shareholder today with 23% of outstanding shares.

David Cowan from VC firm Bessemer Venture Partners that invested in 2015 and still own 16% of shares

Dr. Michael Griffin, former NASA administrator

Several tech industry veterans

So, what makes Rocket Lab’s business so attractive? Why is it better than others? Comparing Rocket Lab’s achievements and potential against competitors really highlights just how far the company is ahead of the pack.

Competitors

A booming smallsat market has attracted more competition than ever in the space launch sector. Long gone are the days of SpaceX being the only billion dollar startup in that industry. Yet, the threat of competition for Rocket Lab is milder than what one would think at first glance.

When analyzing competition here, the analysis must go beyond what cost per kg these companies provide. The space launch industry draws an interesting parallel with the electric vehicle one. In essence:

Releasing the concept of a rocket: easy

Building the first rocket: medium

Reaching a first successful launch: hard

Launching successfully several times in a row: very hard

Thus, while there are dozens of start-ups that have come up with rocket concepts, few have had at least one successful launch, and even fewer have had several in a row. Step 4 is very hard due to the need to have a reliable rocket and not just getting lucky once; as well as being able to scale production while controlling costs to avoid too much of a cash burn.

Apart from the pure engineering of the rocket, capital management is also crucial. Promising start ups such as Vector Launch and Firefly have gone bankrupt following the withdrawal of a key investor each time – although they have both exited bankruptcy today.

And then, finally, comes the actual rocket and the value it provides, which includes:

Cost per kg

Exclusivity of launch, i.e single missions and/or rideshares

Acceptable size and mass of payloads

Available orbits

Launch site availability

Safety / Launch legacy

Time to orbit, from contract signing to deployment

With all of this in mind, let’s get to comparing.

There are dozens of small launch startups in the world. We are going to take a look at the few that could potentially pose a threat to Rocket Lab. Right off the bat, any Chinese startups or new SLLV from China will not be included here since the U.S and Chinese launch markets are almost never intertwined for regulatory reasons. Also, given nationalistic preferences, European startups will be excluded, although that does little to reduce the scope. Thus, PLD Space from Spain and Orbex from the UK will not be considered, but keep in mind they are both running years behind schedule. For instance, PLD was to fly its first orbital rocket by 2020 but this has been pushed back to 2024. Again, space is hard!

The startups that are worth analyzing due to their U.S incorporation, development, and potential launcher capacities are: Astra Space, Virgin Orbit, Firefly Aerospace, ABL Systems and Relativity Space. Vector Launch is excluded due to its decision to develop a suborbital rocket, meaning an orbital rocket probably won’t be launched until the end of the decade at least, which could be too late given the market and Rocket Lab’s evolution. This is how these startups compare in terms of cost per 500 km SSO launch regarding their flagship rockets:

Cost per launch of six startup rockets and SpaceX’s retired F1 rocket. Source: Everyday Astronaut on Youtube

Now, immediately some will want to whip out a calculator so let me save you the trouble:

This may disappoint some that had been reading this post and hoped for Electron to be cheapest of the bunch. But like I said, cost per kg is far from everything.

First, out of these six rockets – we will exclude Falcon 1 from now on as it is retired, but it is still an interesting baseline – only three have actually flown, Rocket, Electron and LauncherOne; and only one has flown at least twice in a row successfully: Electron. The latter has actually flown nearly 10 times more than its nearest competitor. While some may believe that it’s just a matter of time until others catch up, it isn’t:

The SLLV market is already getting too crowded. We calculated Rocket Lab’s TAM at the beginning of this analysis, and there are only so many dollars to go around, especially when accounting for the rideshare options on SpaceX.

Newer entrants therefore have little time to keep testing new vehicles. There is a snowball effect for companies that have gone into the operations phase: they generate FCF, customer relationships, and systematically improve their rockets to lower the costs. Rocket Lab themselves have improved LEO capacity on Electron by 50% since it started launching in 2018.

Companies in the space launch industry are extremely capital intensive: high borrowing rates or a recession could easily break those relying exclusively on debt and investor funding for now.

Furthermore, most of these prices are in theory. Since no company apart from Rocket Lab has launched several times in a row successfully, essentially having continued operations, few know what the actual price point could become.

Another key element is capital efficiency. This can be measured by how much money was needed to develop the rockets and how much time it took to do so. While Rocket Lab was incorporated in 2006, it only started raising capital in 2014, and within 4 years it had a functioning orbital rocket with Electron. By the time Rocket Lab was launching at least one mission every two months in August 2021, it had needed to raise only $275m and used $100m of it to get Electron to orbit – pre-SPAC. Yet :

Virgin Orbit had raised $1 billion and flown successfully once. By April 2022: three successes, four attempts.

Firefly, after its bankruptcy, had raised $210 million but has never flown successfully. By April 2022: no successes, one attempt.

Relativity Space had attracted big capital with its impressive claim of trying to 3D print an entire rocket in 60 days, raising $685 million but having never flown successfully, nor tried to. By April 2022: no successes, no attempts.

Astra had raised $100 million and never flown successfully. By April 2022: two successes out of four attempts, no consecutive successes.

So, Rocket Lab has more experience, early mover advantage, and better capital management than others, except from Astra perhaps.

One final and important element is: is the offering actually interesting? To answer this question, we will pit Rocket Lab against each company individually. I would briefly point out that in any case, I respect the companies and the thousands of engineers that dedicated years of their lives to make them run, and I am grateful for such competition in a sector that has such an importance on our lives.

Virgin Orbit

This is the company I am the least worried about. Virgin Orbit has been developing its launcher for longer than just about everybody else mentioned, only to come up with the priciest rocket there is among the startups. Virgin Orbit has lots of access to capital thanks to Richard Branson, but execution has been poor.

I have long had a tough time with the concept of LauncherOne. The rocket is attached to a modified Boeing 747 and then launched mid-air. Virgin Orbit markets this original system as ‘wherever you need, whenever you need to go’. This sounds good in theory, but in practice it has very little use. For safety and other reasons, rocket launches cannot occur anywhere there is an airport. Specific spaceports are used for a reason, they need to be certified before use. Notably, rockets are often forbidden to fly above populated areas until a certain altitude. Finally, to get the correct orbits, launches have to be made at specific points, which existing spaceports already cover.

The last issue is reusability and further lower launch costs: LauncherOne was built using a 747, so how can Virgin Orbit drive down costs or make it reusable? They can’t modify a 747 all that much more, nor ask Boeing to come up with a solution.

Virgin Orbit’s developments are really long, expensive, and don’t seem to anticipate demand a decade down the line.

Virgin Orbit’s LauncherOne being dropped by a modified 747, shortly before engine ignition. Source: Virgin Orbit

Astra

Astra is quite interesting. For a while it was a ‘stealth company’, and it only unveiled itself a couple of years ago. Astra seeks to be ultra low cost: cheap materials, rudimentary launch pad, etc. The other side of the low cost equation is high volume, which is where I start having my doubts about the company. It also went public via a SPAC, and made some absolutely wild claims there.

Before we get to the financials of it, I have some qualms regarding technical aspects: Astra has yet to have two consecutive successful launches, and its claim of being able to deploy almost anywhere with a portable pad has the same issue mentioned in the Virgin Orbit paragraph.

Yet my biggest grip with Astra is not the technology, but the business model. Assuming that it can maintain its $2.5m launch price at scale, then it would take the company over 55 launches per year to have positive pre-SBC EBITDA, according to its own forecasts. No company in the history of space launch has ever managed to complete 55 missions in 52 weeks. Astra claims it will do so next year. And by 2025, it expects to launch 300 times per year, for $1.5 billion in revenue, up from $4 million in 2021. This also poses problems in terms of launch pad availability despite their claims of being able to launch most almost anywhere. Another issue is mission failures: Astra themselves have said they are targeting a 95% success rate for now, yet when a mission fails operations are often halted for 2 to 6 weeks. In theory, this would mean that when launching 100 missions per year, Astra would actually be grounded for at best two and a half months, at worst for seven months.

Furthermore, the $2.5m launch price assumption can already be questioned: Astra has been reportedly charging $3.5m per launch on its latest launcher, Rocket 3, which also only has 50kg lift capacity for 500 km SSO. These real, not theoretical, figures make the cost per kg skyrocket to $70,000 per kg, almost twice as much as the most expensive of its peers. Rocket 4, slated for 2023, aims for 200-250kg per launch, so assuming the same updated price tag and a 225kg average, Astra could charge roughly $16,000 per kg, which would make it competitive again. Yet, this is once again a theoretical figure.

Compared to others, Astra’s speed and capital use had been really impressive. The company was launched in 2017 and successfully reached orbit in 2021. That’s partly due to it having several SpaceX veterans at its helm, and a business model that requires a rather basic rocket, thus needing less R&D and CapEx spending.

However, since it went public last year its cash burn numbers are out, and things don’t look as rosy: with about $200m in yearly cash burn and around $250m in net cash as of Q1’22, Astra will urgently need to go into debt or raise cash within the next 12 months. Yet, an equity raise would only go so far: at a $1 billion market cap, it would need to dilute shareholders by 20% to sustain just one extra year of operations. Debt would also be a problem: with a hypothetical c.8% interest rate like Rocket Lab has, annual interest of a $200m loan could be a major % of total revenue in 2023.

The issue is, no matter how great the tech is, it has to become profitable at some point. Yes, that requires higher launch cadence just like Rocket Lab, but the numbers Astra lists are just off the charts and I do not think they will be able to come close to it unfortunately. Not looking for reusability in the long-term, i.e for a new rocket down the line, does not seem like a winning bet either.

Essentially, when looking at launch milestones, Astra is about where Rocket Lab was in 2018, four years ago. If it can execute even half of its plans then it will become a serious contender against Rocket Lab, but for now there is little that Peter Beck must be worried about.

An Astra Rocket at the stunning Pacific Spaceport Complex in Alaska. Source: Astra

ABL Space Systems / Firefly Aerospace / Relativity Space

I have bundled these three together as they share two things in common: they are not publicly listed, and they haven’t successfully flown a prototype yet. Firefly Aerospace is a bit ahead, as it has tested a prototype flight but it was a failed mission.

It is hard to comment on these companies given how early they are in the development stage compared to Rocket Lab. Relativity Space has being excellent at getting capital – although I question the real need for a 100% 3D-printed rocket bar marketing material –, ABL Space Systems has a contract worth up to $700m with Lockheed Martin that invested in the company – and in Rocket Lab –, and Firefly is the furthest in development but a previous bankruptcy chapter along with issues with having an R&D center in Ukraine, and a former Ukrainian owner that got into heated exchanges with the U.S government.

On a cost per kg basis, ABL and Relativity’s planned launchers are very competitive compared to the Electron, at a price that is three times cheaper. Yet, again, functioning prototypes haven’t been tested, so in time we will see what happens.

All three companies expect to try a prototype launch by mid-2022.

To conclude, competition is heating up, but for now no one is in a position to really eat Rocket Lab’s cake. Astra is the company’s biggest threat for the next couple of years, but it would need to reach a bar that it set extremely high to actually be competitive.

Rocket Lab has early mover advantage and dwarfs its competitors in terms of experience – which is worth gold in this industry and can lead to poor equity pricing –, capital use, end-to-end services, and future developments with Neutron coming online once some of these rockets may start flying frequently. It is in theory less competitive than most in pricing, but that remains to be seen, and upcoming reusability for Electron should bring down operational costs substantially.

Established Competition

Rocket Lab sometimes competes with established major aerospace companies, but it often does not. Its four main competitors would be SpaceX’s Falcon 9, ISRO’s SSLV, Arianespace’s Vega, and the legendary Soyuz handled by Arianespace but built partly by Rocosmos and Russian companies.

The Falcon 9 is not much of a worry. It has over 70 times Electron’s capacity and already struggles to match the overwhelming demand it receives. Smaller satellites are rarely what the F9 is after, there is no need for it to go after such small – literally – payloads. However, while they may be rare, the F9’s rideshare missions are extremely competitive, at $1m per 200kg for a 500km SSO.

ISRO – India’s space agency – is developing a very competitive rocket. The SSLV would reportedly cost $4m to launch, with a 300kg to 500 km SSO. This is incredible pricing, and ISRO has the prestige to back this up. The agency is known for its amazing low-cost options, including the legendary PSLV. The SSLV would be a serious competitor to Electron, except for U.S government missions of course.

Arianespace’s Vega has a capacity ‘only’ 4 times bigger than Electron but it is not really competitive on price and has issues regarding cadence. Vega is more often than not used for dedicated launches or for two-satellite rideshare missions, each well over 300 kg. With almost twice the Vega capacity, it is the same tale for Soyuz.

Therefore, apart from the SSLV, there are no legacy players that really pose a threat to Electron, except for the occasional massive F9 rideshare mission. Neutron could then dwarf Soyuz and Vega’s capacity, and its 8,000 to 15,000 kg capacity would start rivaling with the F9. Here, there will be a battle and that is why Rocket Lab is trying to make sure that Neutron is extremely competitive right out of the gate.

Valuation

This publication could have been much shorter if I had told you from the beginning that there is a c.150% upside on the stock based off management numbers and you’re just going to have to trust them. When looking at consensus price targets on Rocket Lab, it seems management values were used, as they are almost all within a $17-$21 range. I tried an experiment: in a DCF model, I entered financial forecasts from Rocket Lab management presented in their SPAC merger presentation, used a double-digit WACC and 2.5% terminal value, and there came an $18 price target. I don’t think management’s expectations are too unrealistic, but they really are quite close to a best case scenario. That’s my issue with such a target:

It requires near flawless execution from Rocket Lab.

By definition, a price target is a price level that the company’s shares should reach within the next twelve months. Yet, Rocket Lab’s valuation hinges on milestones that will only partly be within this timeline, so there is no particular reason for it to reach such a price this fast.

On my end, my target was also reached via a DCF but I also acknowledge that it highlighted some of the limits of that model. Given how early we are in Rocket Lab’s life, this is akin to a VC investment, which leans heavily on cash flows in the distant future. Predicting Rocket Lab’s financial performance for the rest of the decade was already a challenge, but beyond that it becomes pure speculation. The target I obtained was:

Price target: $8.3

Upside: 14%

Let’s break it down:

Sales: For the next couple of years, Space Systems will likely be the fastest growing segment, until operational reusability of Electron is possible along with the initial launches of Neutron, in the 2023-2025 period. By 2029, if it executes well, Rocket Lab should go from 1% market share today to 10% market share of the TAM computed earlier. For the next five years, I expect growth respectively of 131%, 80%, 60%, 70% and 40%. Growing Space Systems, increased Electron cadence, and Neutron coming online in 2025 are all factors here. These numbers only tell half of the story due to the point-in-time revenue recognition model for launches, so backlog should also be looked at, and it stands at $545m today.

Gross Profit: Interestingly, over 60% of costs of revenues come from direct labour and manufacturing overhead according to Rocket Lab. This recalls what we said earlier: the material costs of a rocket are actually quite a low % of total COGS. COGS should decrease with both an increase in production cadence and with reusability. Launching with a re-used rocket eliminates most direct costs – refurbishing the rocket is still an expense –, and while it doesn’t amortize manufacturing overhead it is still well worth it. Gross Profit margin is expected to significantly increase in the coming years thanks to a profitable and growing space systems division and more importantly the reusability of the Electron: from D&A-adjusted 4.4% of sales in 2021 to 25% of sales in 2024. Taking SpaceX’s F9 as a reference, 70% of a the rocket’s costs are spent on the first stage. Substracting the costs of catching the rocket – the helicopter is cheap, see above –, of refurbishment, and some fixed costs like manufacturing overhead, about 50% total COGS savings can be achieved for the next five launches – the approximate amount of times a first stage can be relaunched. The same math could be applied to Neutron, adding a 10% COGS savings thanks to a reused fairing, again using data provided by Elon Musk for the F9 fairing. Ideally, years from now Rocket Lab should find itself where demand is so high that it can maximize its use of production capacity while also reusing as many rockets as possible.

EBITDA: other expenses include SG&A and R&D. Rocket Lab has an agreement with the New Zealand government that pays back 15% of its R&D costs. The United States also pays Rocket Lab occasionally for the development of some technologies, most recently it was awarded a $24m contract by the U.S Space Force to help develop Neutron’s upper stage. Stock-based compensation was high in 2021 year due to the merger, but should not be too much of a cost driver in the future.

EBIT: D&A is interesting for Rocket Lab. Launch Services is depreciated with a double-declining method, meaning things such as launch pads, buildings and machinery for launch services are depreciated faster than Space Systems asset. The company has no plans for another launch pad for now, and doesn’t develop too many buildings either – except for a recent announcement of a major new facility for some Space Systems products. Thus, D&A as a % of sales should decrease over this decade, between 6% and 5%.

Change in NWC: Hard to predict given the small amount of past data, but over the next several years it should be negative. Indeed, Peter Beck has stated Rocket Lab doesn’t mind growing inventory; accounts receivable should grow with increased revenue, and do faster than payables thanks to reusability and controlled costs.

CapEx: This industry is quite capital intensive, but half of the capital is used for R&D. CapEx uses the other half, but when building a rocket the biggest cost driver is the testing and man hours spent developing the rocket rather than setting up a launch pad or another facility. Still, I expect CapEx to be at least 10% of sales for the next several years, and gradually come down to 5% of sales in the 2030s decade.

Net debt: following the SPAC merger, the company is cash-rich with nearly $600m in net cash, but this should gradually come down over the years.

TV perpetual growth rate & WACC: Perpetual growth rate is set at 2.5%, well below the expected CAGR of the smallsat industry in the decades to come, but uncertainty must be taken into account. WACC was computed with the flawed but best-of-the rest CAPM method. The 11.5% rate stems from Rocket Lab’s high borrowing costs, and its high Beta. I do not believe that volatility equals risk, but we will have to settle with this method for the sake of comparability.

Comment on debt: Rocket Lab undertook a $100m loan maturing in mid-2024, with an interest rate over 8% and no principal payments until maturity. This should not have a heavy impact of finances, but given the CapEx intensive nature of the industry, bigger loans should be expected, hopefully at lower rate.

SPACs are notorious for their dilution risks due to the high amount of warrants issued. This is no longer a problem for Rocket Lab as it exercised its right for cashless redemption of all outstanding warrants, which was completed in late January. While there are currently about 465m shares outstanding, Rocket Lab’s SBC plan creates a dilution risk of about 50 to 60m shares, which will be issued over time and not over the course of just a year. This future dilution is taken into account for the final price target computation. What isn’t taken into account due to the inability to quantify them, are future secondary offerings. CEO Peter Beck has been open that Rocket Lab went public for the initial cash raise but also for the much easier access to capital markets. Such comments and the capital intensive nature of the industry make future dilution in the coming years almost a certainty, although it is impossible to know how much.

Discounted Cash Flow Analysis with aforementioned parameters

Sensitivity Analysis

These classic financial models can be useful to get a grasp of where Rocket Lab’s finances stand at the moment. Yet I think that the edge when in the comes to investing in the space launch industry is, at least for now, in the qualitative analysis.

All currently public launch companies are losing money at the moment, and they all share grand promises of what the future holds. I genuinely do not believe that an effective analysis of these firms including Rocket Lab can be done through the lenses of a purely financial analysis.

But this is what makes the investment interesting: there is a severe information mismatch in the space industry at the moment, which creates opportunities for high returns. Most of the talk I’ve seen seems to focus almost exclusively on cost per kg and lofty projections made by management. I believe those who look beyond this and at the elements I mentioned earlier will have a substantial advantage over others.

I am convinced the market is pricing these companies very poorly at the moment, and feel some level of confirmation when looking at the market capitalizations of Rocket Lab’s listed competitors.

NB: Astra total launches corresponds to total Rocket 3 launches, as the previous ones were done for pure testing reasons with no expectations of success.

Somehow, Rocket Lab is only worth 1.5x times Virgin Orbit, yet Rocket Lab had 7x sales, lost less money in absolute and relative terms, and has launched 7x more with a better success rate. Astra’s relative valuation is only slightly less staggering, Rocket Lab being worth 4x more but having successfully launched 10x as often, having a much greater success ratio, and actually generating sales.

And these numbers represent only part of the picture: Rocket Lab could be close to reusability and thus major margin expansions and revenue growth, it is actively developing Neutron and all the competitive advantages that it will bring, etc.

These discrepancies stem from what I believe to be a flawed analysis of the SLLV industry by market participants: sales growth and FCF promises are not nearly as relevant as technical expertise and great track records, which are being overlooked at the moment. The edge that Neutron will bring is also likely ignored. The SLLV industry is a bit of an outlier in finance, where guidance usually dictates share prices: past performance is just as relevant as guidance. There cannot be a radical change in sales or margins in the next couple of years without concrete evidence of a systematically functioning launch vehicle. Yet, these SLLV companies seem to be valued with the same mentality behind a scalable SaaS company, with exponential growth just one viral marketing campaign away.

Beyond these issues, the $8.3 price target is purely a reference point, based on my current forecasts on what future cash flows look like and how to discount them. Given how quickly Rocket Lab is evolving, in twelve months the price target could be drastically higher, or even lower. A couple of failed launches would be detrimental. A first flight with a reused first rocket stage or a successful CAPSTONE - a NASA mission to launch a lunar orbiter with Electron, which will also highlight the capacity of Photon and its Curie engine, going much further than LEO in a lunar orbit –mission could exponentially increase the price.

This is where the non-financial analysis is so important: I have bought shares in Rocket Lab at a price in the $7 range, despite it being barely under the price target. That is because, thanks to their past execution, their great management and engineering teams, and their technical edge over other, I believe that the aforementioned positive events have a higher likelihood of occurring than the negative ones.

Risks

There are, of course, various risks:

Launch failures: one failed launch is acceptable, but any higher and Rocket Lab’s most valuable asset, trust, could erode and seriously hurt any future business the company may have.

Inflation: like most companies today, Rocket Lab is likely to face cost pressures. Thankfully, the only company that is somewhat a competitor for now, SpaceX, has recently announced it raised its prices. Rocket Lab will likely do it as well, but it shouldn’t kill its competitive edge. And remember, it’s not all about costs.

Rate hikes: In terms of debt, Rocket Lab should be covered for the next two years, but it does operate in a capital intensive industry which would likely require more borrowing. Rate hikes would therefore affect the business, but lightly, as I forecast interest expenses as 6% of sales this year. The real problem of course is the impact of higher rates on DCF valuations, which is shown by our sensitivity analysis.

Ukraine invasion: the tragic invasion of Ukraine by Russia will actually bolster Rocket Lab’s activities, apart from inflation problems. The Soyuz is now off limits to Western customers except for human spaceflight. This means that some customers could end up using Electron. Down the line, if a couple of years from now sanctions remain in place, Neutron could grow massively. A real example of this has been OneWeb: the plans for its mega-constellation must now change, after having planned dozens of launches on Soyuz. Finally, the war has highlighted the need for satellite data and other space assets, which could bolster space funding.

Excellent execution by the competition: if any of the aforementioned startups, especially Relativity Space and Astra, actually start succeeding in their operations, Rocket Lab’s plans to gobble up market share could be in jeopardy.

ESG

One can guess that ESG-wise, an aerospace company doesn’t fly very high:

Environment: There are actually few studies on how polluting rockets are, however the consensus is that it’s likely not great. Most, including Electron, burn refined petroleum in their first stage at high altitudes. Rocket parts get dumped in the ocean. Rockets themselves use rare materials that don’t have the best environmental footprint in their supply chain.

Social: SLLV companies, including Rocket Lab, tend to have military institutions as customers. Most commercial applications are rather neutral in the public’s opinion, and some are even used to combat climate change. Still, launching military assets bans Rocket Lab from many regulated ESG funds.

Governance: There aren’t any known controversies regarding the board of directors and the C-suite, although there is only one woman on the board. Compensation and equity incentives have not been contested. Rocket Lab works in a high-pressure and fast paced environment, but has extremely dedicated and motivated employees given its mission.

Essentially, Rocket Lab is not a candidate for any ESG investing, but isn’t directly part of the ‘sin stocks’ either since it isn’t a pure-play military contractor.

Conclusion

Rocket Lab is a thriving company in a booming industry, and it leads all of its startup competitors by a light-year, and only faces a direct threat from ISRO for now. An investment in Rocket Lab is akin to a VC investment, as this company is still quite young, has extensive room to grow, but bears execution risk if several launches fail or development plans lag on for too long.

I personally found this investment compelling despite the lackluster DCF results, due to markets mispricing its peers and a major information mismatch. In today’s hyper connected world, quant analysts and algorithms or armies of fund and sell-side analysts are hard to beat. Yet the SLLV is quite young in public markets, and as such there is little clear information on how to value such companies. This rare discrepancy makes a Rocket Lab investment all the more interesting, as qualitative analysis rules here, instead of typical financial ratios.

As a final word, the space industry as a whole has a wonderful online community and many great content creators. On YouTube specifically some channels that I have known for a while and some newer ones were quite useful thanks to their in-depth interviews with an open CEO, and the passion and details these interviewers bring to the table: Everyday Astronaut, Scott Manley, The Space Bucket, young up-and-comer Felix’s Space Time, and so many more. A big thank you to all of them!

A couple of fun vault videos to close this off:

A local New Zealand news broadcast from 2009, less than 3 years after Rocket Lab’s founding, reporting on the company’s first successful suborbital launch.

A younger Peter Beck speaking at a diner in 2009 as well, pitching Rocket Lab when it was working on suborbital missions.

Disclaimer: I, the author, hold shares in Rocket Lab, USA Inc. as of the publishing of this article on April 29th, 2022. The contents of this article do not constitute financial advice, please conduct your own due diligence.

Great write up. What are your current thoughts? A year later.

What a great and informative writeup you made!