flatexDEGIRO | Already forgotten for the wrong reasons

Forget the memes, pricing fl(at)ex, and more private equity

Threads and other finance-related tweets @AlaricsPicks

Edit on December 6th, 2022:

Please read this update carefully before reading any other element on this page.

Yesterday, flatexDEGIRO held an analyst call to discuss the results of a BaFin investigation. The German financial regulatory authority identified “shortcomings in some business practices and governance”, mandating “flatexDEGIRO to ensure appropriate business organization and [issuing] temporary capital surcharges.”

Furthermore, flatexDEGIRO reported disappointing guidance for FY 2022: €380m in revenue, down 9% year-over-year. It included an adjusted EBITDA of 37%, which is indeed the result of efficient cost-cutting, but also of increased higher-margin lending activity following ECB rate hikes, a macroeconomic event $FTK has little control over. The guidance is especially disappointing given Q4 saw more risk-on trading activity, which has positive correlation with retail trading activity.

The announcements led the price to crater 37% during the day.

Here are more details on what the BaFin investigation implies:

Additional risk-weighted assets requirement of €300 to €400m…

… To comply with an increased CET1 requirement: from 11.6% before the investigation to 17% today (15.5% regulatory requirement + 1.5% management buffer)

The supervisory and management board have decided to capitalize flatexDEGIRO Bank AG with additional EUR 50 million out of their own retained funds. Also: “given the current flatexDEGIRO Group CET1 of approx. EUR 180 million and the net profits 2022 to be fully retained, management sees all future growth efforts are adequately financed, with solid regulatory funds and without the need for any capital measures.”

Over 100 middle and back office staff will be added, leading to an increase in personnel count and personnel expenses of “high single digits year-over-year”

All of FY 2022’s profits will be retained to comply with BaFin requirements, despite management hinting in Q3 that shareholder returns in the form of buybacks and dividends could arrive very soon

The completed audit itself will be a one-off item for FY 2022 with a c.€2m cost

flatexDEGIRO aims to no longer be constrained by enhanced capital requirements by the end of 2023, and to have all new internal control systems, compliance and government structures up by mid to late 2024.

flatexDEGIRO knew about the audit being launched 4 to 6 weeks ago. When pressed by an analyst asking why public stakeholders were not alerted then, the company CEO said it would have created turmoil and left people in the dark, he would rather release all the data once the picture was clear.

The only positives out of this call are the aforementioned increased operating margins, but they must be nuanced as we have just seen. CEO Frank Niehage also bought shares today, but not an egregious amount relative to his former position.

My overall view on the matter is, unsurprisingly, that these announcements are dreadful and put into question the investment thesis I had outlined below earlier in the year.

I do not think the company is doomed however, far from it. BaFin has tightened its oversight over German financial institutions since the Wirecard scandal, and all across Europe banks often get little slaps on the wrist for failing to 100% comply with regulation. flatexDEGIRO grew quickly these past couple of years and saw its status as a financial institution change rapidly. It is not an excuse for its shortcomings, but it does add some context.

On the valuation side, the company now trades at 5.5x 2023 EBITDA (assuming 10% growth next year and same margins, driven by lesser market turmoil and further lending impact of higher interest rates). It even trades at just 2.5x net cash.

I don’t think the company should be completely dismissed, but the investment thesis has changed quite dramatically. flatexDEGIRO is far from a value stock, but it isn’t a growth one per se today. More importantly, there is a massive regulatory overhang making this a far riskier investment than before.

One major element that will perhaps make me rethink my position is the lack of transparency from management, who I believe should I have warned all shareholders about the situation from day one of the investigation.

These announcements are incredibly disappointing, and I hope this update brought a clearer picture to anyone confused by recent events.

I hope you will continue to follow me on my next analyses and thank you to all those who have been along for the journey.

*****************************

Edit on April 27th, 2022:

flatexDEGIRO released their interim Q1’22 results today. Revenue and average revenue per trade fell short of what I had expected, however profitability widely exceeded my expectations, despite increased marketing costs. The EBITDA beat thus allows the expected future cash flows to remain as expected, and my price target does not move.

Looking back, I seriously overestimated transactions growth, thinking that high volatility in the markets linked to the Ukraine invasion and central bank rate hikes would lead to a strong trading increase. Yet, flatexDEGIRO has announced that customers actually stayed relatively put, and did not participate in the massive sell-off we witnessed over the quarter. This can be construed as either a positive, seeing the company’s customers as more mature than the ones at other retail brokers; or as a negative, as this could announce a trend of lower activity throughout the year. Compounding the revenue miss from my forecast is that share of U.S trading volume dropped from 28% to 21% QoQ due to European stock trading increase with the war, which by default halted the potential for FX revenue growth.

One final comment is that flatexDEGIRO was able to grow customer accounts as much as I expected, and they did so while increasing their profitability, which I thought they would through increased revenue per trade. Yet the increase in profitability stems from better operational cost control, which is a consolation prize after the lower than expected revenue per trade.

Looking forward, it will be interesting to see if the company can maintain this staggering 43.8% EBITDA margin against an expected 33% margin, and if it can reach the expected 20% growth on the year despite being on track for ‘only’ 13% growth when annualizing Q1.

Retail brokers tend to get as much love from their customers as insurance brokers or telephone providers. The best these companies can wish for is that we never have to think about them, since if they ever do pop into our heads, it’s for all the wrong reasons.

Yet flatexDEGIRO actually had the reverse effect on me. After passing my first ever stock order through my legacy French bank’s brokerage arm, I immediately looked for an alternative. Indeed, the Luxembourg-listed stock order had a whopping 19.35% fee tagged on to it, over two years of average S&P500 index returns. I have kept the historical artefact of the receipt on my HDD, waiting for the niche expensive-digital-banking-receipts NFT market to take off – any day now.

After some research, I decided flatexDEGIRO – Bloomberg ticker FTK:GR – would be the best alternative. My choice was based on commission fees, product offering, actual stock ownership (and not CFDs), and the UI. After several years as a satisfied customer, I checked to see if it was a listed company, and to my surprise it was. As I dug deep and went over and over again into the company’s strategy, its positioning and its financials, I ended up analyzing a wonderful company that seems to have an excellent future. However, despite fairly strong coverage from the sell-side, the stock has been in a rut over the past six months, and it is down over 40% from its all-time high last summer despite improved prospects.

Executive summary

Data used in this analysis are based on flatexDEGIRO’s closing price of €16.78 on March 7th, 2022.

flatexDEGIRO is what is known as a ‘retail’ broker, i.e it serves retail investors and not financial institutions. More specifically, it is a German low-cost retail broker, offering rock-bottom fees on trades. For instance, purchasing $1,000 worth of Apple shares would cost me just over $3, or 0.3% in fees. Its product offerings include stocks and ETFs, bonds, ETPs, FX services and more – cryptocurrencies are currently not available. In 2020, flatex bank and DEGIRO merged to create the largest European retail broker, flatexDEGIRO. Today, FTK leads the low-cost market in terms of prices and number of users – over 2 million –, while still growing faster than all of its peers. It is doing so profitably, with net cash, and without major shareholder dilution. DEGIRO has long relied almost exclusively on its cash flow from operations to grow, and continues to do so today, while generating strong positive free cash flow.

Current market capitalization: €1.9 billion

2021 revenue and trades : €418 million / 91 million transactions settled

Assets under custody: €44 billion

Price target: €30

Upside: 77%

Given current prices, flatexDEGIRO is deeply undervalued, trading at 4x 2024E EV/EBITDA, and upcoming catalysts including a buyout make this company even more attractive. Most of them are not being taken into consideration enough, or are even ignored by market participants at the moment, they include:

A recent Bloomberg leak of private equity firms looking to buyout flatexDEGIRO, rumors the company did not deny.

An overlooked impact of a new pricing structure in terms of FX fees, which could increase revenues per trade by up to 20% next quarter QoQ. New ETP offerings should also help boost revenues per trade.

Strong cost control thanks to its rare vertical integration since the flatex & DEGIRO merger, handling IT, processing and banking operations in-house, giving it a scale advantage over most competitors.

Substantial pricing power and capacity to up-sell.

A misunderstanding of what actually drives growth: pricing power and taking away market share from other participants, instead of just hoping that non-investors start being traders.

A misunderstanding of client profile: FTK’s client base is much more robust than for other low-cost brokers, partly thanks to flatex’s heritage. There is also an inherent stickiness with clients, due to great customer service among other elements.

A misunderstanding of risk: FTK is not as exposed to volatility risk as one may believe at first glance. Also, current macro risks that have dragged the market down along with FTK – interest rate hikes, inflation, and the Russian invasion of Ukraine – have actually little negative effect on FTK, although the war could create a detrimental ‘stagflationary’ environment.

A temporary contraction of 2021 margins partly due to an unfortunate timing of an SBC offering and one-off marketing expenses.

An extremely volatile quarter which should boost Q1 earnings.

Opportunity in case of an E.U and/or U.S ban of Payment-for-Order-flow (PFOF), which FTK only relies on for external hours trading, but some companies like e-Toro rely on much more.

The company now has adjusted-EBITDA margins of over 40% and seeks to reach 60% by 2026, which I consider rich and estimate closer to 50-55%. It aims for €1.5 billion in sales and cumulated operating cash flow by 2026, while I predict €0.9 billion in sales. I believe it should grow by 20% this year then see 13% CAGR for its revenue between 2022 and 2026.

The cash-generating capacity of this company along with its lack of debt give its shares substantial upside on a DCF, confirmed by a peers valuation.

Business Overview

flatexDEGIRO is the European leader in low-cost financial broking services in terms of transactions settled and customers, with now over 2 million customers and over 90 million settled transactions in 2021.

The retail broker sector is crowded, but FTK has been seeking to differentiate itself with its rock-bottom fees, great product offering and good customer service.

It recently switched its pricing model, using a flat fee of 0.5€ for some European countries, and the same flat fee for E.U from/to U.S trading along with a 0.25% FX fee.

Two-thirds of trading revenue comes from shares and bonds trading, the rest is from exchange-traded products – ETPs – through investment bank partnerships, ETFs and FX trading. A negligible amount of revenue is generated by commodities trading – only for some pro accounts – and CFDs, the latter representing well below 5% of revenue.

Trading commissions account for c.85% of total revenue, the rest coming from interest on conservative margin loans. There is still revenue generated from the legacy finance IT business, but it is slowly being phased out.

Its customer service call center is entirely based in Leipzig, Germany. From my personal experience, service members are quite knowledgeable of financial markets and quickly answer any queries. One can also request a stock or ETF be added onto the platform via e-mail, which usually occurs 48 to 72 hours later.

Assets under Custody by product and trading revenue by product for end of FY 2021. Source: flatexDEGIRO Q4 2021 investor presentation. ‘Other’ includes options, futures and CFDs.

Crucially, flatexDEGIRO does not use PFOF – Payment for Order Flow – except for extended-hours trading which is a negligible part of revenue, and even then customers can opt out of PFOF. This distinction is important as several neo-brokers rely on PFOF or similar business models to generate revenue. PFOF consists of market makers paying brokers a small fee to have trades be routed specifically to them, which raises the issue of the customer actually getting the best quote possible on a trade or not. Trade Republic is perhaps FTK’s biggest private competitor and uses PFOF. While it claims ‘commission-free’ trading with only a flat 1€ handling fee, its customers pay an indirect fee when they don’t get an optimal quote on their offer.

PFOF has already been banned in DEGIRO’s home country, the Netherlands, for some time now, but it is still legal in other parts of the E.U and in the U.S. Yet, a draft law set to reform EU MiFID was written late last year and could very well pass this year, sending shockwaves in the industry. flatexDEGIRO recently started being vocal about this, frequently explaining their PFOF position to shareholders and hoping to capitalize on a potential acquisition at a cheap cost if a neo-broker were to go down.

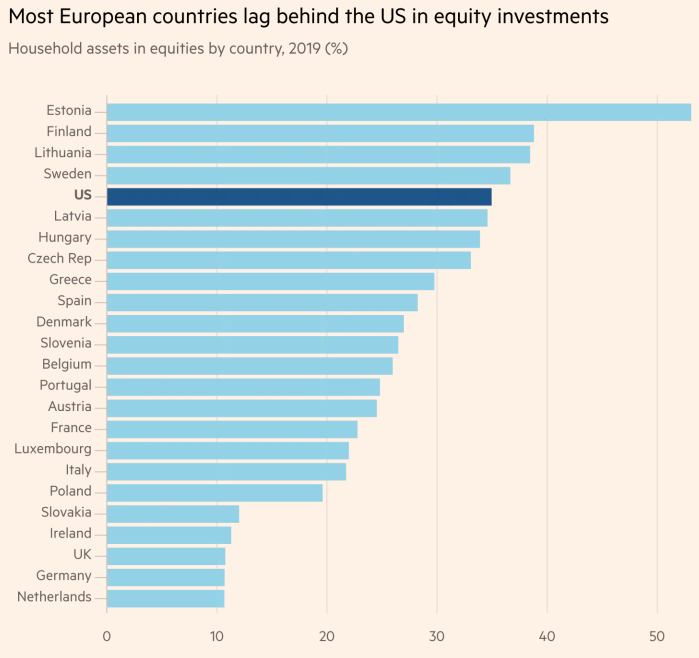

To understand FTK’s leading position, we must first understand the European retail broker market. For starters, it is not as big as in the United States: only 25% of Europeans are invested into equities, against over 50% in the U.S. This is mainly due to cultural and social differences, where retirement plans do not rely on stock market performance but are instead the result of national pooling and redistribution. Europeans have long been savers rather than investors, a fact that is only starting to change recently with the newer generations. The notable exceptions are Nordic countries, where investing culture is much more widespread.

Source: OECD; Financial Times

For over two decades now, that market has been fragmented. There are very few retail brokers that have substantial business outside their home country. Avanza, a Nordic bank that offers retail trading, Swissquote, a Swiss bank and retail trader, and Bourse Direct, a French broker, have largely stayed in their countries or very close neighbors despite their growth. They never branched out and sought to expand into the overall European market because they did not feel they needed to do so. They had great local brands which created trust – an extremely valuable asset in financial services –, and were very profitable. Why risk entering new markets where they are unknown and don’t understand the culture, all the while needing to burn cash? flatex and DEGIRO both understood that beyond these issues could rise a massive opportunity. In 2019, flatex entered the Dutch market against DEGIRO, and both firms quickly realized that an alliance made sense.

flatexDEGIRO is now a fully-integrated broker, which allows it to significantly cut down on fees and processing costs. Conversely to other brokers, it does not outsource IT, processing such as settlement and transaction clearing, nor bank functions such as KYC. It thus has CAC – customer acquisition costs – of about 50€ (+/- 20%), against well over 100€ for most competitors. Its CAC recoverable period is just over 12 months for 1/3rd of customers, 6 months for another 1/3rd, and 1 month for the final 1/3rd. Its peer Avanza has a global CAC recoverable period of 12 months. FTK has the cash using discipline of both firms, including DEGIRO that never did a fund raiser – bar its merger, technically – and never had negative net debt. The FCF positive aspect of the firm is in stark contrast with younger start-ups burning cash at fast rate with high customer acquisition costs.

This here is one of the key aspects of FTK’s business model: profitable growth through expansions in several E.U countries using strictly cash flow from operations.

It’s important to note that FTK’s customer growth strategy is two-fold. On the one hand, it is entering what it calls the ‘underdeveloped G7’, a group of developed countries with a lack of online banking and brokerage use. This has a massive TAM, but runs the risk of people just not wanting to get into retail investing. An inflationary environment could partially offset this however, with typical savings accounts now offering negative real yields. On the other hand, and this is often forgotten, FTK is seeking to acquire other brokers’ market share when breaking into their market. Its ultra competitive prices, targeted marketing campaigns and good design has already allowed it to steal market shares in Western Europe, and to do so profitably.

They also seek to acquire the right customers: the bottom half of AuC accounts have €2,500 or less in their accounts, which is over 10x more than in neo-brokers. These customers aren’t highly leveraged and barely trade options. FTK also has a great churn dynamic, with 2.5% customer accounts churn this year but 1.3% trades churn and 1% revenue churn: the accounts leaving are the least active ones, not the hot ones that got burnt.

Source: flatexDEGIRO 2021 Strategy Day presentation

Source: flatexDEGIRO Q4 2021 presentation

They have been able to maintain high margins, including increasing revenue thanks to the second key: pricing power. FTK does an excellent job at not only growing its amount of users, but also its ARPU, even being able to reach 44€ for users with less than 200€ in their accounts. It does this in two ways.

ARPU per AuC cohort for active investors. Source: flatexDEGIRO Q4 2021 presentation

The first is by offering more products and services over time, and by increasing certain prices. Over the last five years, DEGIRO has substantially widened the amount of equities that are tradable on its platform and developed a large ETF offering; while flatex has been building several partnerships with IBs such as Goldman Sachs recently to offer lucrative ETP products to its wealthier investors. Continuous product offerings have allowed it to increase customer revenue regardless of user growth. Future offerings should include cryptocurrency trading – a risky offer that has led FTK to take its time in order to find a suitable partner – and regional special offerings such as the PEA investment account in France.

The second way is through price hikes, where FTK makes sure it does not come at the cost of active user numbers. The latest example was showcased late last year. FTK decided to change its pricing structure for its growth markets, simplifying it by applying the same flat fee with no variable fee in each country: 0.5€. FTK called it ‘Degiro Goes Zero’ given that there are no commission fees. This is misleading however and I wished they had not run this slogan, as there is the 0.5€ handling fee and a FX fee for US trades. Regardless, the change in pricing included an increase in the FX fee, going from 0.10% to 0.25%. FTK ran pilot programs and realized it did not affect customer behavior, despite them being made aware of the changes. This will lead to a substantial increase in revenue per trade which we will analyze in our Valuation section. flatexDEGIRO was able to do this because it already undercuts its competition by a mile, but also thanks to the stickiness of its service. Customers like their service, and switching costs between brokers are often very high and are not worth small price hikes.

DEGIRO new FX fees compared to peers. Source: ‘Degiro goes Zero’ presentation

DEGIRO reviews in Italy, Spain and France against their national peers. Source: Trustpilot, ‘Degiro Goes Zero’ presentation

flatexDEGIRO’s moat is excellent cost control thanks to it being fully integrated, a great product offering and up-selling capabilities, and a good understanding of each regional markets. Start-up brokers can’t compete profitably nor without burning hundreds of million in cash, and legacy banks already have lucrative brokerage businesses with high-fees and don’t see the point in entering such a competitive race.

These elements have enabled FTK management to lay out their ‘Vision 2026’ program. Note however that they are widely considered to be too optimistic, so I have included my predictions alongside:

€1.5 billion in sales / €0.9 billion in sales

60% adjusted EBITDA / 50-55% adjusted EBITDA – adj. EBITDA removes SBC

250 - 350 million transactions / 180 million transactions

7 - 8 million customers / 5 million customers

Risks

So what’s the catch? There are various risks that flatexDEGIRO and all European retail brokers are exposed to, let’s break them down and see if FTK has reduced exposure.

The biggest risk is a slowdown in trading activity, either through less user growth or less activity in the markets. Reduced user growth could happen if FTK fails to deliver on its so far successful growth strategy. Less activity in the market however, is more out of FTK’s hands. While it can mitigate this by continuing expansion in growth markets and up-selling, a sustained drop in volatility will still end up hurting the top line.

One potential way to hedge this risk is through options. Volatility could be deemed low when the VIX index is below 15. Thus, buying puts the furthest out possible with a 15 strike price can allow one to offset potential losses in the case of an overly-calm trading year. Unfortunately, VIX options only trade 9 months out. A way around this is trading short strangles on the S&P500 or Stoxx600, i.e selling slightly out-of-the money calls and puts, which creates a net profit in case volatility is low and the seller is not assigned. Obviously these options strategies are much more complex in practice and require careful arbitrage of the options’ price themselves, but this is the idea.

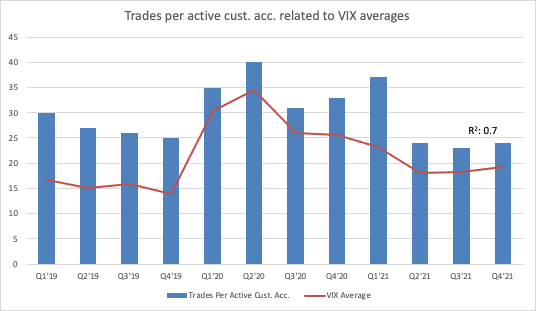

Keep in mind, however, that while there is obvious correlation between volatility and FTK transactions, it is not a 1:1 affair. FTK still generates substantial revenue and cash even in periods of lower volatility, and client trades aren’t perfectly correlated with the VIX, with an R-squared correlation of ‘only’ 0.7 over the last 3 years:

Trades per active customer accounts in relation to the quarterly VIX average. Source: FRED, CBOE, flatexDEGIRO, own computation

Another common fear regarding retail brokers is that during a prolonged recession, traders and investors get wiped out. This risk, common to most brokers, is a fair point. Retail brokers are especially exposed due to high revenue concentration from some frequent traders, and FTK is no different. Only 10% of their client base make over 100 trades per year, and only 2% over 500. Over 50% of trades are concentrated in 2.2% of their customers. This is not atypical, but it remains an important concentration risk. The one aspect where FTK stands out is regarding margin loans. Traders tend to lose money faster when highly leveraged, but FTK is rather strict with the margin loans it authorizes. The average loan value is of 33%, requiring investors to put down two-thirds of equity. It offers mainly fully-secured loans with interest rates of 300-500 bps.

Another set of risk that needs to be addressed are today’s global risks: interest rate hikes, inflation, and the tragic Russian war on Ukraine.

Regarding interest rates, hikes would be a delight for the business of FTK. 2.8 out of the c.€43 billion it has under custody are in deposits, about half is being used for margin lending and the other half is in reserve for future lending. If planned rate hikes, for instance those of the Fed, were to go ahead, then FTK could increase its loan rates by 150 bps – the expected Fed amount. FTK generated c.€60m in commission income in 2021 at a rough average of 4% interest, so assuming no assets under custody growth, this could easily generate over €20m in extra revenue this year, 5% of 2021 revenue. The real issue with interest rates comes of course, from valuation mechanisms. The WACC used in our valuation was 8%, increasing it to 9% brings the price target from 30€ to 26€, providing ‘only’ 55% of upside. Thus, it seems there is a certain margin of safety regarding interest rates.

On inflationary pressures, we have already discussed FTK’s pricing power, which it should be able to continue flexing if necessary. It would be all the more easier in a global environment where every broker has to raise their prices too, and would squeeze out zero-cost or low-cost but unprofitable brokers, potentially opening the door to a cheap acquisition.

Finally, on the Ukraine invasion, flatexDEGIRO has no direct exposure. It does not serve the Ukrainian nor Russian markets, and is only as affected by commodity price hikes as all of us, as it provides a fully digital product. Furthermore, volatility has a reversed correlation with major geopolitical events. Yet, an era of E.U ‘stagflation’ would lead to a drop in investing, and a slowdown of user growth and trading.

Valuation

DCF and multiples results. Please note that 2021 is still ‘2021E’ since only preliminary earnings have been released for now, which include revenue, adjusted EBITDA and a few other metrics. 2019 is flatex revenue exclusively. EV ratios drop substantially in last years due to net cash accumulation.

Price target: 30€ | Upside: 77%

I believe flatexDEGIRO trades at a substantial discount, especially after weeks of a global market downturn due to events that do have an effect on FTK, but not nearly as the price drop suggests. It is trading at 2.1x 2023E EV/Sales and 5.6x 2023E EV/EBITDA while being expected to grow over double-digits.

I expect the company to grow 20% this year, after a massive 60% growth in 2021 partially due to the early year meme-stock mania. For the 2022-2026 period I expect revenue CAGR of 13%. This revenue growth will be driven by:

User growth in the ‘underdeveloped G7’ markets, first by acquiring market share from other brokers then by reaching newer investors.

User up-selling in the more mature markets, as well as partially in the growth markets*.

A few future price increases leading to increased revenue per trade.

Higher margin loans thanks to higher central bank interest rates, with a potential 5% revenue growth from 2021 revenue just from these hikes.

*Revenue per trade was up 8% in Q4 2021 at 5.22€ per trade, after a continuous year of increases - Q1 revenue per trade was lower than usual due to small retail accounts trading meme stocks, and German and Austrian new customers getting a special offer where they could trade 6 months for free. The new pricing structure could substantially increase revenue per trade by up to 20%, here is a quick breakdown:

FTK had different pricing structures in its growth markets for US stocks, with the most common one – in France, Spain and Italy – being $0.5 + 0.004$ a share, along with a 0.1% FX fee. Now, it asks for €0.5, along with a 0.25% FX fee. This analysis would be substantially longer if I broke down the reasoning but essentially, the new pricing structure is extremely advantageous for FTK for stocks trading over 2$ a share, which is the vast majority of NYSE and Nasdaq-listed stocks. FTK claims that in 2020 there were around $50 billion traded between its customer accounts and US exchanges. The number should be a bit smaller for 2021 and the next couple of years, let’s say $40 billion. In nearly all trading scenarios, the new pricing structure is extremely lucrative, with at least an extra $60 million potentially generated in 2022 just thanks to this price increase – 0.25% of 40 billion instead of 0.1%, subject to the relatively small loss from the 0.004$ per share. That represents 14% of 2021 revenue.

Average revenue per trade in 2021. Source: flatexDEGIRO Q4 2021 presentation

Margins should see an increase and 2021 should be seen as an outlier year:

SBC: a stock-based compensation plan was signed in May 2020. In the first half of 2021, the stock traded at 3 to 4 times the price of when the plan was signed, leading to significant SBC provisions booking. The plan has been almost entirely vested already, and no new one has been signed yet. If it does, the potential strike prices should not be as far removed. However, if it were to be the case, it would mean that shareholders would already be very happy.

Marketing expenses: flatexDEGIRO decided to produce a mini movie regarding the world of investing. I am not sure how useful it would be, but it cost over €5m to make and distribute, i.e over 10% of this year’s marketing expenses.

By 2022 all synergies between flatex and DEGIRO should be well in place.

Management expects CAC to remain around 50-60€ despite growth, which should increase margins. It also believes staff costs will remain flat.

Free cash flow is already scheduled to be c.7% of market cap this year, and should keep growing substantially without a stock price increase:

flatexDEGIRO is an extremely capital-light business, with little need for CapEx – except servers.

Cumulated cash flow from operations could reach €1.3 billion between 2022 and 2026.

The company is very conservative with its cash deployment, only using it when a cheap acquisition is possible. It has not promised to do so but should cash start piling up within the next 2-3 years, it has said that it may launch a buyback program.

Simply put, the DCF gives the company a high valuation due to its ability to print cash, with yearly FCF over 200% of net profit in the past couple of years and slated to remain over 150% in the following years.

D&A and tax rate should remain stable, respectively 7% of sales and 29% of EBT. The company should remain without debt in the foreseeable future, maintaining its culture of growth through cash flow from operations. WACC is set at 8%, Terminal Value at 1.5%.

Without dilution, EPS is slated to grow at 19% CAGR in the 2022-2026 period.

A quick multiples check confirms our analysis, using multiples provided by Jefferies late last year and updating to current market conditions with a 25% discount. The peer group includes Avanza, Nordnet, Swissquote, FinecoBank, Hargreaves Lansdown, and AJ Bell.

Conclusion & Catalysts

flatexDEGIRO seems to be often shun for the wrong reasons. Yes, the price has run up substantially in the past couple of years, but that is no reason to simply look away. The business has become much better, its prospects has improved, and it will keep printing more cash in the future, yet it trades at the same price as it did over a year ago – and there was no significant dilution.

This broker is well aware that the meme-stock mania of Q1 2021 was a one-time event, and does not need it to happen again to drive growth. While volatility is FTK’s biggest risk, it is not inevitable either and both FTK and its investors can have their bets hedged.

The stock price has lingered on for no company-specific reason, and presents an interesting buying opportunity. The Bloomberg news leak of private equity firms seeking to buyout flatexDEGIRO a couple of weeks ago was not surprising, given its lack of debt and its cash-generating operations, while trading at such a discount. The flatex and the DEGIRO co-founders both know it too, still owning a combined 20% of the company – other co-founders are also still shareholders.

Management was not mentioned in our analysis, but the current flatex CEO, Frank Niehage, joined flatex in 2014 after being a managing director at Goldman Sachs. The current DEGIRO CEO joined in 2015 and became CFO before reaching his current position.

On a personal note, FTK has not taken the Robinhood or e-Toro approach and presented its product as a game. While brokers are somewhat neutral on the ESG scale, those specifically representing investing as some kind of game fail on that aspect. FTK presents its app with a clean UI, but not a gamified one.

Disclaimer: I, the author, hold shares in flatexDEGIRO as of the publishing of this article on March 8th, 2022. The contents of this article do not constitute financial advice, please conduct your own due diligence.

Very informative analysis.

I think FTK is uniquely positioned to increase its market share in Europe.

One think I don’t like is their pro forma figures. They exclude SBC provisions from SARs issued in 2020. This is totally deceiving since SBC is a very real operating expense (its actually a cash expense that just takes gets recorded in parts earlier). I am pretty sure that when SARs get exercised, management will exclude the corresponding cash expense. Don’t you think that this is a sign of management dishonesty, trying to paint a brighter picture?