In May 2023, ASOS released P1 earnings, and undertook £275m in debt (term loan and RCF), as well as a £75m equity raise that diluted shareholders by 20%.

The investment case has changed substantially. Details here:

https://twitter.com/AlaricsPicks/status/1664310496743260160

For a couple of decades, Y2K was synonymous in the mind of many with the fear of a surge in computer glitches on the dawn of the year 2000. For Nick Robertson and his colleagues, it was the year everything would change as they incorporated AsSeenOnScreen, a then little-known online website selling clothing seen on TV series and the big screen.

Today, the meaning of Y2K has radically changed, yet ASOS remains closely linked to the acronym. Clothing inspired by late 1990s/early 2000s fashion, a.k.a “Y2K Fashion”, has become all-the-rage with Gen Z and some 20-somethings after being ridiculed for years and thought to be as dead as Furbies hype – although some of these still sell for thousands.

Britney in her “Sometimes” music video (left), promotional picture for an ASOS product (right). Source: Jive Records, ASOS

ASOS’s landing page is now reminiscent of the oldest millennials’ yearbooks. Yet, the company has been able to reinvent itself for the entirety of its existence with its innovative culture after facing several stumbling blocks, the latest of which came in 2022, sending shares down into a tailspin.

Thankfully, forecasting a company’s financial position years from now is actually an easier endeavor for me than predicting this summer’s next fashion trend, although it remains just as subjective.

Let’s give this exercise a try and see why ASOS may also be worth a second look.

For more commentary on equities, tweets teasing write-ups I take ages to actually release and the occasional random tweets, follow @AlaricsPicks on Twitter.

Please note that ASOS uses a fiscal year (FY) ending on August 31st.

All references to the stock price such as multiples and upside are based on the price at closing on February 24th, 2023: 822 GBX.

Finally, note that the author of this publication evaluates debt and operational/financing cash flow on a pre-IFRS16 basis. All data from FY2020 and beyond is rebased on a pre-IFRS16 basis.

Executive Summary

Company: ASOS Plc

Industry: Consumer Discretionary

Country HQ: U.K

Market capitalization: £822m

52-week range (in GBX): 490 - 1877

% down from ATH: 86% - April 6th, 2021, 5826 GBX.

Price target and upside: 1253 GBX, 52% upside.

ASOS plc (Bloomberg ticker - ASC:LN Equity) is a UK-based online fashion and beauty retailer, trading 86% lower than its all-time highs reached less than two years ago, despite suffering from little structural issues and seeing Covid-related ones withering away. The company trades at 2.6x FY2025e EV/EBITDA, despite EPS being scheduled to grow at 20% CAGR from FY2023 to FY2025, and FCF expected to exceed £160m by then which would be the second highest level ever.

It is also trading at cheaper forward multiples than its listed peers, despite being better positioned for the future in our view.

Like many other retailers, whether physical or online, ASOS has been caught wrong-footed in 2022, as the company failed to anticipate the level and impact of inflation. Its inventory levels surged, sales were flat, profitability disappeared and FCF cratered to (£332m). On top of that, the company continued to spend heavily on CapEx for software, automation and other supply chain improvements.

Yet, we believe that most of the issues that weighed down ASOS’s results were far from structural. We also believe this crisis to have been a great opportunity for ASOS to stop its hyper-growth focused model that had started taking its toll on some elements of profitability and cash generation while generating dwindling returns, with a ROIC that had been on a years-long decline before the pandemic, dropping from over 200% to 9% between FY2016 to FY2019 for instance.

Management was vastly revamped in recent months, including a new CEO that made his priorities clear: rationalize, optimize, but keep growth at an adequate pace. His short tenure is a risk factor of course, but so far he has stayed the course.

We believe ASOS will come out stronger from this crisis, with a greater focus on cost control and inventory management that has already started to bear its fruits.

Hence, we believe ASOS to be currently trading at a good discount. Unfortunately, the share price ran up while the author was writing this piece. An upside of 52% for a high-beta stock is by no means a bargain, so while this opportunity is interesting, we are aware of its limited potential unless ASOS surprises significantly to the upside.

Business Overview

Description

ASOS plc is a £800m+ UK-based online fashion and beauty retailer. It was founded in 2000 by Nick Robertson, who was its CEO until 2015, Andrew Regan, Quentin Griffiths and Deborah Thorpe.

ASOS caters to the “20-somethings” with its products. It provides affordable clothing, quickly and sometimes with free shipping. ASOS has its own brands such as ASOS Design and Collusion, but 60% of its FY2022 sales come from external brands such as Nike, Lacoste or Carhartt, among many others.

The company has c.26m customers, processes 100m orders per year throughout over a hundred international markets, and generates nearly £4bn in revenue.

As we will see below, it faces stiff competition: for instance Bohoo, which is also based in the UK, or the fast-rising ultra-fast-fashion Chinese juggernaut Shein. While it is hard to rival these companies, ASOS has been holding well thanks to quality, value, marketing, and an ethics campaign that we will all cover in this analysis.

Examples of clothing for men and women on ASOS.com. Source: ASOS.com

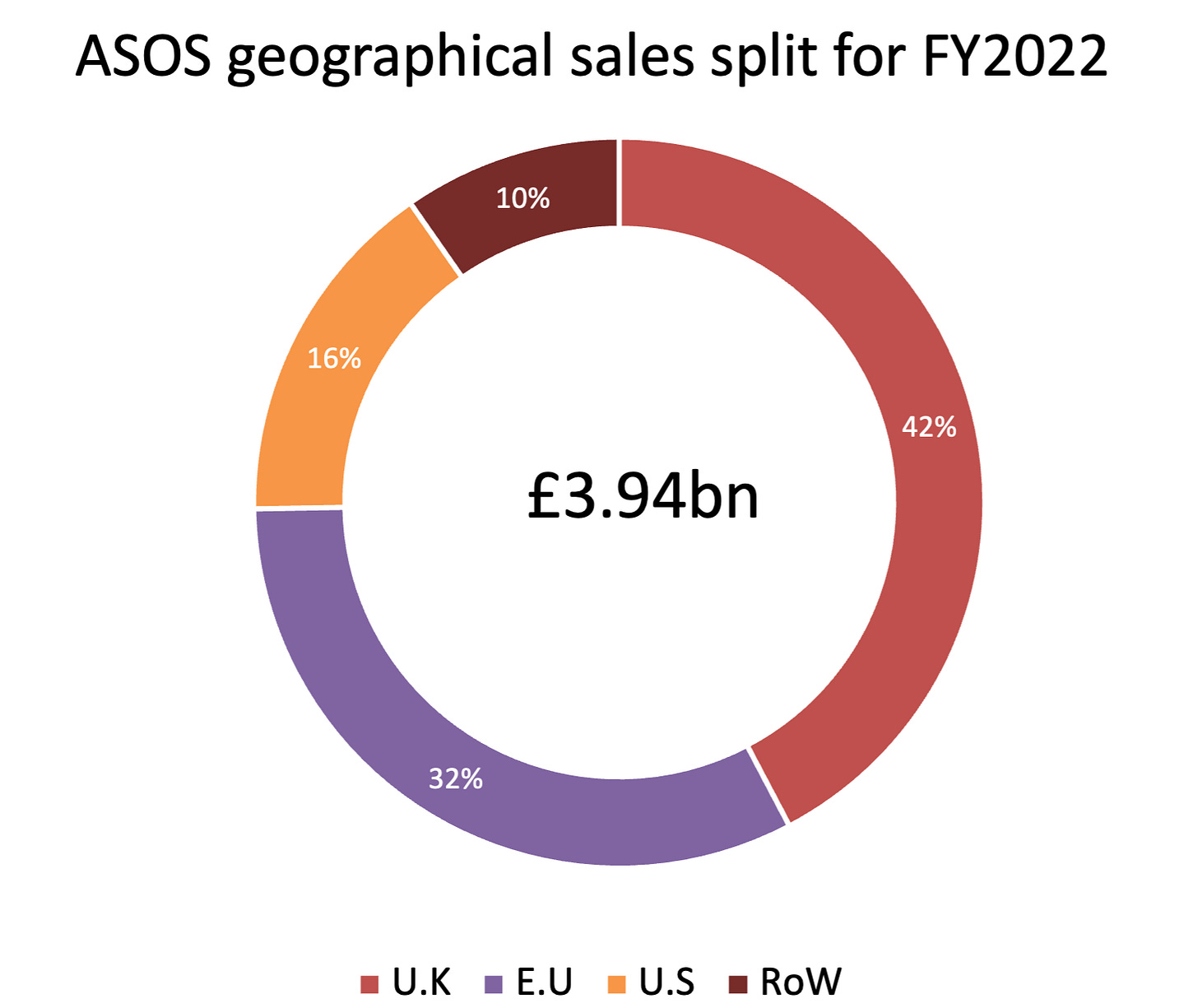

ASOS 2022 sales split by regions. Sources: ASOS 2022 annual report, own analysis

Despite international expansion, most of ASOS’s sales come from the U.K, where it has established solid market share: it is the number 1 online brand for clothing sales in the country for 16 to 34 year-olds, and has a 35% penetration rate in the 16-24 year-old category.

As for outside the U.K, the E.U is the second driver in sales, notably with a 15% penetration rate in the 16-24 year-old category in France, and 5% for the whole of the E.U. Then comes the U.S, at the core of ASOS’s strategy, and finally Rest of the World - RoW - which ASOS has recently started seeing as less of a priority.

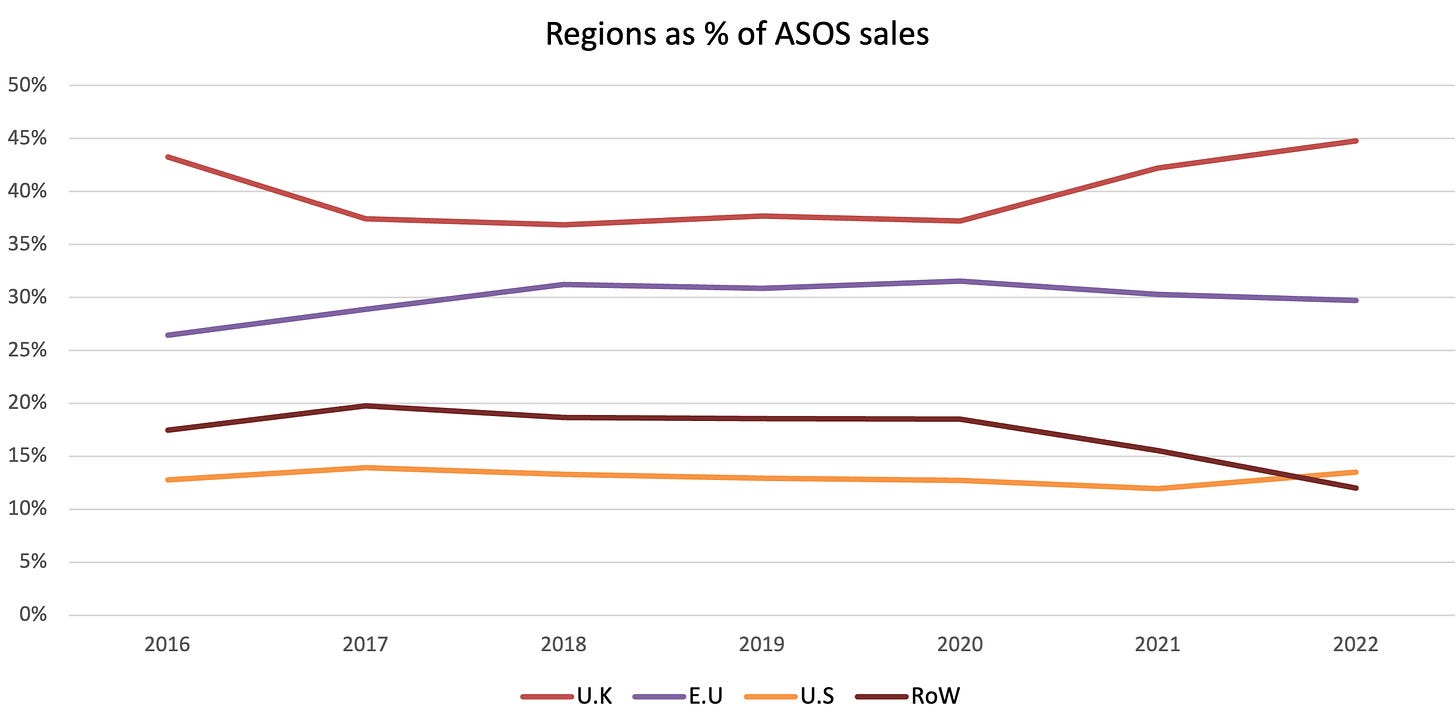

ASOS regions as % of sales since 2016. Sources: ASOS annual reports, own analysis

Company History

ASOS was founded in 2000, and was then known as AsSeenOnScreen. Originally, the company only sold clothing that had appeared on TV or the silver screen, but over time, and after officially changing its name to ASOS in 2003, it expanded its offering and sold all types of clothing with a focus on “20-somethings”.

In 2010, the company started expanding internationally, opening online shops for France, Germany and the U.S. It also stopped selling clothing for kids that year, only two years after launching the project.

FY2014 was a challenging year for ASOS and its shareholders, as the company shed 60% of its market capitalization. Slowing growth, a strong pound, start up losses as it entered the Chinese and Russian markets, and a fire in one of its main warehouses in the U.K were all to blame. While some of these elements were outside of ASOS’s reach, investors punished the company’s overly-ambitious investments in logistics and technology, in what would end up being a recurring topic. A little fun fact is that ASOS was an F1 sponsor that year, plastering its name on the McLaren team’s cars.

A McLaren at the 2014 F1 Austrian Grand Prix. Source: McLaren Racing

In FY2016, ASOS became yet-another company to realize that turning a profit on its Chinese business would be too difficult, and shut down local fulfillment operations. Customers in China can still order from ASOS, and China remains the country with the most ASOS factories, followed by India and Turkey.

FY2019 was the second tough year for the company and its shareholders, the share price seeing another 60% drawdown. The company admitted to have “underestimated the impacts of large scale operational change being executed on two continents simultaneously”, as it sought to grow aggressively in the E.U and in the U.S. Shipping issues and warehouse start-up difficulties plagued the company. The growth halved from 26% the previous year to 13%, and FX could not be blamed here as constant currency numbers were roughly equal. EBIT margins collapsed from 5% to 2%, mainly due to changes in logistics and warehouses. It even ended the year with £0 in cash and equivalents, but could still operate thanks to its negative net working capital model, where suppliers take several weeks to get paid whereas customers pay full fees upfront - although some opt for BNPL options.

Unsurprisingly, the Covid-19 pandemic ended up being a boon for ASOS, same as for other e-commerce businesses. Growth was now at 19.4%, the EBIT margin recovered to 4.6%, and free cash flow reached a record £257m. The FCF increase must be nuanced however: from 2020 and onwards, CapEx went from over 8% of sales in years prior to around 4% of sales, and in nominal terms dropped to a level unseen since 2016.

In April 2020 ASOS launched an equity offering of around £250m, diluting existing shareholders by around 20% but shoring up its finances. This would prove wise, as the company was able to operate without too many problems and expand its operations despite turbulent times.

One thing to note however was the start of another trend besides CapEx: shrinking gross margins. Between 2018 and 2022, they dropped linearly from 51.2% of sales to 43.6%, and 2020 was firmly in that trend with 47.4% gross margins. Yet, distribution and administration expenses dropped, going respectively from 15% to 13% of sales in the same period, and 32.3% to 31% of sales - and 27.5% in 2021.

FY2021 was also a great year for ASOS, as nearly all metrics continued on a positive trend. The notable even that year was the acquisition of a number of brands from the Arcadia Group, which was in administration at the time, for around £300m. The brands were Topshop, Top Man, Miss Selfridge and HIIT brands. M&A contributed 3.4 percentage points to the 19.8% growth that year. Better yet, the acquisition was partly financed by a £500m convertible note offering, with a low 0.75% coupon and a near-£8 strike price, making it incredibly cheap given share price performance since. Further analysis of ASOS’s debt is provided further down below.

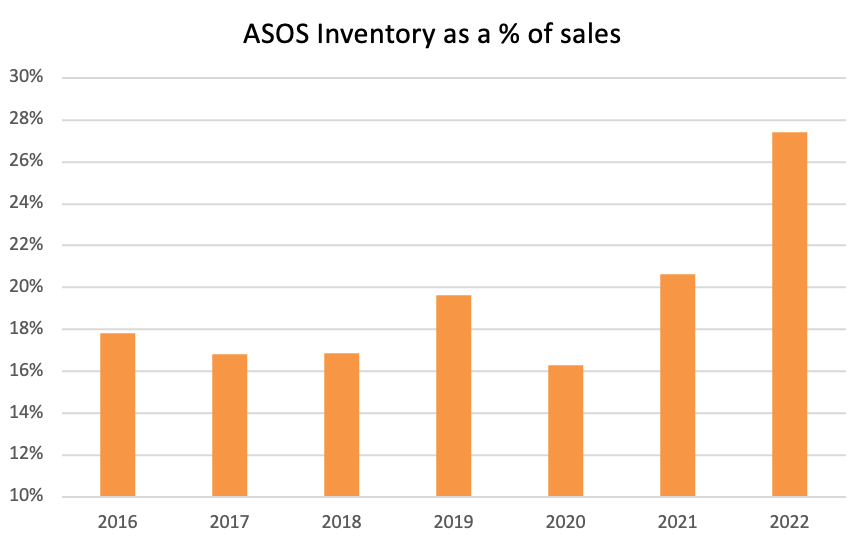

Finally, in FY2022, ASOS suffered its third tough year. Growth was essentially flat at 0.7% - 2% on a constant currency basis and 4% when excluding Russia -, margins collapsed as EBIT turned negative or was at 0.7% when excluding one-off items such as vacating an office space and the amortization of some acquired intangible assets. Net working capital was positive due to an explosion in inventory, which until that year had never gone past 21% of sales, but that year reached 27.4% of sales. ASOS was hit hard by inflation, especially in the U.K and through supply chain issues. Sales in the Rest of the World segment cratered by 22% as consumers in emerging countries also had to deal with sky-high inflation numbers, and ASOS pulled out of the Russian market following the Ukraine invasion.

ASOS sales and EBITDA margins since 2016. Sources: ASOS annual reports, own analysis

Underperformance in FY2022 led to a substantial reshape of ASOS leadership. Jørgen Madsen Lindemann was elected Chairman of the Board, and José Antonio Ramos Calamonte became CEO. José Calamonte had previously been Chief Commercial Officer at ASOS since early 2021, CEO of Portuguese clothing retailer Salsa for a couple of years beforehand, and otherwise spent years as CCO of Esprit and as a Commercial Director at Carrefour.

The appointment of José Calamonte was initially met with disappointment by shareholders, with the share price cratering over 30% on the day of the announcement.

Yet, the latest earnings data suggest José Calamonte’s plan of heavily rationalizing operations is starting to pay off. The new CEO outlined his plan shortly after being appointed:

Reduce the use of markdowns and promotions to return to higher gross margins.

Have a more flexible approach to stock, using near-shore sourcing and further use ASOS’s Partner Fulfils, which effectively has brands directly fulfilling orders placed on ASOS’s website and app instead of having them go through an ASOS fulfillment center. This should reduce stock in fulfilment centers.

Implement a new commercial model and structure to shorten ASOS’s buying cycle, such as introducing more off-site routes to clear products earlier in their lifecycle, thus enhancing speed to market and improve curation. ASOS’s day sales in of inventory for instance, has increased 41% from 110 in 2017 to 155 in 2022.

Overall cost base optimization, improvement of supply chains, and refocus on key markets.

Rationalize CapEx to be more in-line with future capacity requirements.

Reinforce leadership team and company culture.

In the most recent trading update in January 2023, ASOS showed parts of their plan started taking shape, as:

Over £300m in profitability measures were identified, such as removing 35 unprofitable brands from the platform, winding down three ancillary storage facilities, and reducing staff costs by 10%.

Inventory rationalization began, with the company on-track to reduce it by 5% between FY2022 and FY2023

Return to cash generation in H2 FY2023 and beyond

ASOS has also evolved in a time where consumers and investors have become more demanding regarding sustainability topics. ASOS operates in the fast-fashion industry, known to be highly polluting due to its reliance on massive consumption, enormous amounts of textile that are also often poorly sourced, mediocre quality, and worldwide shipping.

The company has sought to clean its own image on a lot of these matters. While it does a far better job than some of its peers on certain sustainability topics, the very nature of the business means ASOS will likely never be a sustainability champion. Still, the company has made significant progress over the years and has ambitious goals for 2030, all of which be looked at below.

Market Overview

Consumer discretionary markets are not the most sought-after at the moment. High inflation has put a dent on consumer spending worldwide, although some economies are holding up better than others.

The online apparel market

In the U.K, where ASOS generates nearly half of its sales, online clothing sales dropped 4.6% in January year-over-year according to Interactive Media Retail Group. KPMG and the British Retail Consortium put non-food online sales, a partially comparable metric, down 3.6% YoY. What’s worse, overall U.K retail sales actually rose 4.2% YoY, so e-commerce clothing sales were down despite a mostly favorable trading environment. These numbers are also unadjusted for inflation, meaning online clothing sales are likely down 15% in real terms.

E.U data is not available at the time of writing but is expected to have declined YoY in both unadjusted and real terms.

In the U.S, January e-commerce sales were up 8.4% YoY according to the MasterCard SpendingPulse report, while overall clothing and clothing accessories sales were up 6.3% according to the U.S Census Bureau. These numbers are also unadjusted for inflation, so online apparel sales are likely about flat on real terms.

Online apparel forecasts vary between forecasting institutions, but overall CAGRs to 2025 are forecasted as follows:

UK: 5%

E.U: 15%

U.S: 12%

Global (including aforementioned regions): 11%

Those who have followed us for some time know we don’t like discussing TAM - total addressable market - for well-known industries, as it is quite an intangible number that is often quoted to impress rather than serve as a parameter in an analysis. So, we will just state that estimates for the global e-commerce apparel market range from $450bn to $550bn depending on sources.

Yet, regional market growth rates seem to only matter slightly as ASOS is far from being a mature company. Its regional growth rates are often rather uncorrelated with overall regional trends, in the past six years for instance:

ASOS yearly growth rates by regions. Sources: ASOS annual reports, own analysis

Inflation

However, the number one priority on investors’ mind is inflation. The U.K has been the worst hit country among Europe’s major economies in terms of inflation. Headline YoY inflation in the U.K in January was still in the double digits at 10.1% - with clothing at 6.5% - , while its neighbors in the Eurozone saw an 8.5% YoY inflation rate.

Month-over-month, the U.K’s CPI fell 0.6% while the Eurozone CPI was down 0.4%. Yet, this was the U.K’s first MoM CPI drop in over a year, whereas it was the Eurozone’s third consecutive drop. As I said in my previous analysis, covering Sofa Carpet Specialist - $scs.l - speculating on future U.K inflation rate is a tough endeavor that this analysis will not undertake. It is clear to us however, that U.K inflation is in an overall downwards path and is likely to have peaked in October 2022.

U.K CPI since 2014. Sources: BBC, Office for National Statistics

Shipping

Finally, a third element that is also dependent on the global inflation rate are shipping costs. The majority of ASOS’s factories being in China, then India and Turkey, the cost of shipping is a crucial factor in the profitability of its business. In fact, it accounted for 1.8 percentage points of its drop in gross margin between FY2021 and FY 2022. Its generous return policy, often free of charge in its biggest markets for a minimum basket order value, makes ASOS even more reliant on the shipping factor.

Yet, shipping is starting to be much less of a thorn on the company’s side. Freight rates have collapsed over the past couple of years from the late 2021 highs. The Freightos Global Index for instance has seen rates collapse over 80% from their highs, and now sit “only” 50% above their pre-pandemic average. By the end of 2022, freight rates per route were down:

73% for the Asia / North Europe route

78% for the Asia / U.S East Coast route

90% for the Asia / U.S West Coast route

Global Freight Rates over the last three years. Source: Freightos

Management & Shareholders

ASOS was a founder-led company for most of its existence. Co-founder Nick Robertson led the company from its founding in 2000 to 2015. Afterwards, Nick Beighton took the helm until October 2021, now-former CFO Matthew Dunn acted as interim CEO, and ultimately José Antonio Ramos Calamonte became the current CEO, starting in October 2022.

ASOS’s newest CEO José Antonio Ramos Calamonte. Source: ASOS

These changes in CEOs are not particularly worrying, what is more concerning is the string of CFO changes over the last 7 years, where 5 different individuals took the job, 4 when excluding an interim CFO. While we cannot draw conclusions from this matter, it is worth considering for any investor thinking about allocating capital to this company.

In terms of remuneration, ASOS has a share incentive program titled ASOS Long Term Incentive Scheme - or ALTIS. The measures for the CEO’s grants in FY2023 are as follows:

25% for Total Shareholder Returns (share price appreciation and potential buybacks or dividends, although the company has made no such hints)

30% for EPS growth

30% for Revenue growth

15% for ESG objectives

We consider these targets to be quite adequate, although we would have liked to have seen an added element concerning return on capital or equity: ROE, ROIC, or ROCE.

The CEO and other executive directors subject to the plan are expected to hold their shares for a certain duration after vesting. Here is a close-up of José Calamonte’s remuneration plan for FY2023:

ASOS CEO José Antonio Ramos Calamonte’s compensation plan by levels of company targets achievements. Source: ASOS 2022 annual report

We can compare this data with a study of FTSE250 constituents’ remuneration of CEOs conducted for the 2021 calendar year conducted by Willis Towers Watson. While it varies, ASOS is currently ranked 28th in the index, or FTSE 128.

ASOS CEO FY2023 remuneration plan against FTSE 101-150 median for 2021. Source: Willis Towers Watson. Note: (*): ASOS discloses that max LTIP remuneration can increase to 500% of base salary in certain circumstances but does not disclose details. Source: Willis Towers Watson.

Thus, the ASOS CEO compensation plan can be deemed acceptable, as it is only slightly higher than the one provided at the company’s peers.

The company’s largest shareholder is Danish billionaire Anders Holch Povlsen, CEO of international clothing holding Bestseller, through his investment vehicle “Aktieselskabet af 5.5.2010”, with a 26% stake. Povlsen has been a major shareholder since 2016, with stakes fluctuating between 25% and just below 30% to avoid having to make a mandatory public offer - ASOS has only one share class, giving one vote per share. Thus, while a takeover offer is not out of the questions, one should not consider it as a catalyst, as he has had numerous opportunities to conduct them - as recently as last year - but did not do so.

The second largest shareholder is California-based hedge fund Camelot Capital Partners LLC with a c.11% stake, which also owns a similar stake in competitor Bohoo. The fund has had a stake for years, but increased it between 2021 and 2022 from c.5%.

Other shareholders include T.Rowe Price, Frasers Group, and Schroders, with no stake higher than 6%. Nick Robertson had a 3.3% stake in FY2021, but in FY2022 that stake went below the 3% threshold ASOS uses to report shareholder ownership.

Valuation

ASOS has seen a derating due to stalling growth and other issues regarding financials, high inflation impacting its operations and consumer demand, and an unfavorable U.K macro environment.

Yet, we believe ASOS’s valuation, that we will break down below, remains attractive.

The company trades:

at 11x 2023E EV/EBITDA, nearly half its 21.3x 7-year average

below book value, the first time in at least 7 years - although admittedly this is due to massive inventory increase

at its lowest EV/Sales multiple in over 7 years, at 0.3x vs the 1.5x 7-year average. The perhaps more accurate EV/Gross Profit multiple stands at 0.7x against the 3.1x 7-year average.

P/E, EV/EBIT and FCF yield are all negative due to a tough FY2022, but we do not believe these issues to be structural at all, as we will show below.

Lower multiples make sense when the company is expected to grow less, and while we believe it will never see double-digit growth again except for FY2024, the company’s shift towards profitability warrants higher multiples.

It does not even have to surpass its operating margins seen in recent years, it just needs to match them by the end of the decade to justify our valuation.

U.K Equities at historic discounts

We previously covered the macro headwinds the company faces, but some of these seem to be turning: inflation is at an inflection point, shipping prices have collapsed, consumer demand is mild but is unlikely to get much worse as recession fears now look to have been overblown, etc. Yet, U.K markets still trade at historic discounts compared to peer markets.

U.K equities saw their valuations collapse in 2022, not least due to the disastrous mini-budget presented by the Liz Truss administration; and overall the country has been on a consistent underperformance trend over the last years.

Forward P/E ratios per selected regions and countries. Source: Refinitiv, Yardeni Research

One should not expect U.K equities to trade at the same premium as U.S equities or even, since Brexit, the premiums given to Economic Monetary Union equities. The country has lost parts of its financial and economic appeal since Brexit, it struggles to have a stable government, consumer confidence it at lows not seen since the 1970s according to the GfK Group, and its economy is having difficulties growing. Today, its double-digit inflation rate dwarves numbers seen in the U.S and the eurozone.

Yet, it seems to be valued at en exaggerated discount against other comparable regions and countries, and even relative to its own history. Its forward P/E ratio - where E stands for operating earnings in this particular case - is near its 2008 and 2011 lows, respectively at the height of the GFC and prior to its second QE program after the first one failed to relaunch its economy. While the U.K is, for now, expected to be the only G7 country to suffer a recession in 2023, this consensus is being thrown into doubt as more data emerges showing strong growth in several parts of the economy. Essentially, U.K equities are being valued on levels close to when it was entering a massive recession, whereas today there are debates on whether a recession will even happen.

Fundamentals

ASOS’s FY2022 financials look horrible when compared to previous years.

It had it all: flat growth, collapsed operating margins, highest levels of net debt in years, (£300m) FCF loss, etc.

Yet, when looking at these numbers more closely, the picture gets much brighter, providing us with a 52% upside.

Sales

Sales in FY2022 were down 5%. Broken down by region:

U.K: 6.7%

E.U: (1.3%) / 2% CCY

U.S: 14.0% / 10% CCY

RoW: (22.2%) / (20%) CCY

The E.U performed poorly as the Ukraine invasion started to impact energy prices across the Old Continent first, especially in Germany, and France saw a strong return to physical sales. Rest of the World had a catastrophic year as ASOS pulled operations out of Russia. Still, excluding Russia sales remained down by 9% on a CCY basis, as ASOS has started reducing spending on customer acquisitions and is having difficulties competing against local players.

As for the good performers, the U.K saw the impacts of the Ukraine war slightly after the E.U so it is less reflected in FY2022, and the Topshop brand acquisition boosted sales. The U.S saw Average Basket Value - ABV - up 4% CCY, while active customers decreased by (1%): consumers are buying more premium items while ASOS pauses its agressive marketing campaign in the country.

As for sales forecasting, we believe ASOS will refocus on its core markets further as well as the U.S, and see RoW growth in low to mid-single digits per annum for the next several years:

The U.K is reeling from inflation much more than its E.U / U.S counterparts, and we expect it to continue for FY2023 as we forecast a 10% drop in sales for the year. Sales were down 8% in the four months ended December 31st 2022 - called P1 2023. While inflation may have peaked since, consumers will still feel the pain of higher prices for months to come, and consumer credit remains expensive. We do see growth returning at low double digits 2024-2025 as the U.K remains a dynamic market, but still down by half from its 5-year average of 20%.

U.S sales grew by 15% in P1 2023. Yet, while it may hold such growth for the remainder of the fiscal year, we forecast growth at only 10% for similar reasons than the U.K, and also because the U.S has long relied on marketing for growth, which ASOS will now severely halt with its new profitability-oriented strategy. Growth for 2024-2025 is also expected to be in the low double digits, as some marketing spend will return over those years and ASOS shifts to a more premium sales mix.

E.U sales increased by 7% in P1, and we conservatively expect 4% growth for all of FY2023, impacted by continuous inflation. Yet, the E.U saw a 5% increase in active customers in FY2022 and remains a massive growth market for ASOS with decent EBIT margins that we will see below. Competition from ultra-fast fashion players may slightly eat into the company’s regional growth, so we forecast low single digit sales growth as well for 2024-2025.

RoW sales were down 30% in P1, 10% excluding Russia. ASOS’s new strategy excludes high marketing spend in RoW countries, and a couple of months in 2023 will continue to affect results being compared results prior to Russia’s invasion. Thus, we forecast a 23% drop in sales for RoW in FY2023. For 2024-2025, we expect RoW to become much less of a priority for ASOS in order to reduce the use of air freight, streamline operations, and focus on other markets, thus we see mid-single digit growth for the period.

In total, we expect ASOS to generate just over £4.5 billion in sales in FY2025, down over 30% from its original plan of £7 billion around 2024-2026 outlined in late 2021. This means ASOS will grow it sales by only 16% between 2022 and 2025, mostly due to a (5%) sales drop in FY2023. A massively different macro picture with high inflation and high interest rates, a new plan focused on profitability rather than growth at all costs, and the exit of the Russian market, all come into play here.

ASOS will be further aided by a “premiumrisation” of its customers, through its premium program that has seen great growth and Net Average Basket Value that grew from £36.65 in 2018 to £40.38 in 2021, a 10.2% increase.

In our view, this forecast is not conservative but rather neutral.

Margins

In FY2022, ASOS continued a poor trend of dwindling gross margins. From FY2018 to FY2022, gross margins steadily declined by around 200bps per year, going from 51.2% to 43.6%.

This is due to several factors with varying weight over the years:

Product category mix: more comfortable wear during lockdown for instance

Freight and duty: for instance increased freight rates since early 2021, higher duty costs when entering the U.S

Promotional activities and markdowns: ASOS has been more and more reliant on promotional activities over the years to drive growth, likely pressured by competitors

FX: varies each year, with an impact of +/- 200bps sales growth numbers

In the future, we do not expect ASOS to ever return to gross margins of 2019, 48.8%, and before. Indeed, the company now relies on the U.S market for 13% of it sales, and it is unlikely that U.S duty rates see a drop anytime soon. Furthermore, FX was favorable in those years, and while we cannot model future evolutions of FX rates, it is more prudent to at least consider FX impacts to be neutral.

However, the low gross margins seen in the FY2021-2022 period were the result of non-structural issues.

ASOS FY2020 to FY2021 Gross Margin bridge. Source: ASOS investor presentation

ASOS FY2021 to FY2022 Gross Margin bridge. Source: ASOS investor presentation

Freight and duty costs had over 250bps of negative impact on gross margins over the period. Unlike previous years, it is mostly the freight aspect that led to lower margins, rather than the duty element. As we previously mentioned, freight rates (both sea and air) soared as the world started started exiting lockdowns. Yet, global shipping rates have collapsed since early 2022. We expect nearly all these issues to be solved by FY2025, adding around 200 bps of gross margin, but still weigh slightly on FY2023 results.

Furthermore, ASOS is seeing a clear shift in category mix, notably in the U.S, as shoppers start to embrace more premium products as well as ASOS’s premium subscription which also lifts gross margins. While shoppers looked for lower-end comfortable clothes during lockdowns, as restrictions were lifted higher-end, higher-margin clothing was being sought. Topshop has also been a contributor to improved gross margins.

Finally, ASOS has seen its buying margin continuously improve over the years as it scales and becomes a more dominant player in the online apparel space. To remain somewhat conservative, we do not expect its buying margins to improve from here on out, but to still be maintained at high rates. Meanwhile, promotional spending is expected to slow, which should also boost gross margins.

Ultimately, we expect ASOS to reach a 46.5% gross margin by FY2025, and to be capped around 48% by the end of the decade.

For 2023 however, we conservatively model it to reach a low of 41.5%, as the company writes off over £100m of inventory and conducts one-off strategic reorientations and closures of some facilities. The company reported a 36.1% gross margin for P1, or 42.9% adjusted for inventory write-offs of £90m. It expects its gross margin to significantly improve in the second half of the year.

ASOS D&A has not changed materially over the last years, so we simply expect it to be maintained at around 3.6% of sales for the future.

What is quite interesting is that, despite gross margins dropping in previous years, ASOS has been able to maintain its EBIT margins.

ASOS yearly gross margins and EBIT margins since 2016. Sources: ASOS annual reports, own analysis

This is thanks to great improvements in operating efficiency over the years:

Distribution expenses as a % of sales went from 15.8% in 2018 down to 13.3% in 2022, despite a poor year.

Staff costs have dropped from 7.9% to 5.1% in the same period

Administration expenses are rather flat for the period, but had gone down from 31.2% in FY2018 to 27.5% in FY2021

Distribution expenses dropping is quite logical and a direct result of lower gross margins: higher duty rates and one-off distribution center opening costs in the U.S for instance led to lower gross margins, but reduced distribution expenses as the company could now distribute its products more efficiently to U.S customers through localized distribution centers.

While ASOS’s sales grew over 50% in the FY2018-2022 period, its headcount dropped by around 25%. The amount of tech workers increased by the same relative amount, and the amount of fashion-linked employees grew a bit, but operations staff collapsed by around 50%. This is partly due to ASOS’s large investments in automation, which it will now halt.

To remain conservative, we model distribution expenses as a % of sales to remain near their FY2022 levels for the next decade, and administration expenses to only slightly improve and reach 30.5% of sales by the end of the decade.

This, along with high single-digit sales growth and improvements in gross margins, provides us with a 3.25% EBIT margin in 2025, growing to 4.5% by the end of the decade.

An analysis by region gives us a near-identical 2025 EBIT margin, at 3.22%, using sparse data provided by ASOS, with the latest batch in the 2021 Capital Markets Day.

For anyone curious about energy costs, ASOS has indicated that they made up 0.2% of FY2022 sales and will represent a similar amount in FY2023. Electricity and gas contracts are fully contracted until October 2023, from that point they may well increase, but even a doubling of the prices would not have a very material impact on the company’s results.

Interest and tax

We expect interest payments to range between £20m and £30m over the decade, with FY2027 and beyond simply modeled on FY2026. We will breakdown ASOS’s debt below, as we believe it not to be problematic as opposed to other analysts who have issued concerns on this topic.

Tax rate is modeled at 25% from FY2025 onwards, we do not speculate on potential cuts from the Rishi Sunak/Jeremy Hunt administration. We do not expect ASOS to pay corporate taxes in FY2023 and FY2024 due to IFRS losses incurred in FY2022 and to be incurred in FY2023, along with the likely use of tax assets in FY2024 despite a likely profit.

Free cash flow

We have already discussed future operating profits and D&A.

ASOS operates on a negative working capital basis, as customers pay upfront whereas ASOS takes weeks to pay its suppliers, and, for a while at least, its inventory grew at an adequate pace in sales. Accounts payable and receivables can slightly vary, and we have modeled to be rather steady over the next years. However, the wildest factor is inventory. FY2022 was catastrophic, when inventory as a % of sales spiked:

ASOS inventory as a % of sales since 2016. Sources: ASOS annual reports, own analysis

This has a disastrous effect on free cash flow, and ASOS suffered a (£259m) impact on FCF.

We firmly believe this to be a temporary issue. ASOS did not anticipate in mid-2021 that inflation would substantially spike and that consumer confidence would collapse.

The company is now writing-off inventory and rationalizing it overall. For precaution, we have forecasted this ratio to never return to FY2021 levels, dropping to 21% by the end of the decade. For FY2023, we believe it will drop to 26%, from 27.4%, following up to £130m in inventory write-offs and reduced inventory purchasing.

One quick side note we would like to make is around stock-based compensation. High-growth companies, especially ones that partly or completely revolve around technology, often tend to spend substantial amounts in SBC. Depending on one’s calculations, SBC can make a company’s cash flow look much better than in reality.

ASOS however, is not one of those companies. Since 2016, SBC as a % of sales as averaged around 0.24%, with a 0.40% peak hit in 2017 and the lowest amount just last year at 0.02% of sales. ASOS does have an employee share plan, but the amounts included are tiny. Most of the shares issued come from ASOS’s long term-share “ALTIS” plan, that we will talk about below when discussing management and board topics.

As mentioned earlier, we account for leases in a pre-IFRS16 manner on the balance sheet and in free cash flow. Hence we do not include them in debt, but we must account for repayment of principal portion of lease liabilities in cash flow from operations, resulting in an extra £25m to £40m of cash outflow per year in the next decade.

ASOS CapEx and CapEx as a % of sales since 2016. Sources: ASOS annual reports, own analysis

For years, ASOS invested over 5% of its sales in CapEx:

around half of those expenses were dedicated to technology, and more particularly software to improve the entire product delivery chain, enhancing data analysis for instance

the other half of these expenses went to supply chain investments: new warehouses, automation of the warehouses, etc.

In 2021, ASOS had plans for increased relative CapEx spending, but has since reined in some of those objectives. It has not given quantified guidance on future CapEx spending. Yet, we know it plans to close some warehouses while making others more efficient, and maintains nearly all CapEx technology spend. It also aimed for CapEx to be 3-4% of revenue at its Capital Markets Day in 2021. Thus, we can be conservative by estimating CapEx in the same range over the decade.

Debt

The debt portion of the company’s finances is interesting. It can be broken down into three elements:

A £500m convertible debt

A £22m loan

While not technically debt, ASOS has access to a £400m revolving credit, of which £250m are drawn.

The convertible debt is incredibly favorable for ASOS. The company announced in early April 2021 that it had secured it. Here is the ASOS stock price over the last five years:

ASOS 5-year share price history as of early March 2023. Source: Google.com

ASOS secured the financing very close to the peak of its post-Covid valuation. The consequences were phenomenal, as these are the terms of the debt:

Coupon: 0.75%

Convertible strike price: 7965 GBX

Maturity: April 2026

Around the time of the underwriting, the shares needed to appreciate by around 45% for the debt to be convertible into equity.

At current prices, the shares now need to appreciate by a whopping 870% to be converted. If all the debt were to be converted once the strike price is matched, current shareholders would be diluted by around 6%: seems to be well worth it.

Additionally, given that this debt was convertible, the coupon rate was discounted, and thus sits at a tiny 0.75%. Today, this portion of debt is closer to £450m, the rest being an equity provision, but here is a fun exercise - we will exclude taxes for simplicity: if ASOS were to put a third of its FY2022 cash and equivalents, roughly £107m, in a 1-year U.S Treasury bill which currently yields 5.05%, it would be able to service its convertible debt for the year and still have £1.5m in profit.

Next comes the £22m loan. It was provided by Nordstrom, a major physical and online apparel retailer in the U.S. In the deal, Nordstrom bought a very small stake in ASOS, provided a £22m 6.5% coupon loan, and now displays some ASOS apparel in its stores. No maturity date was provided. Assuming no debt capital repayment until maturity, this costs ASOS about £1.4m a year for the foreseeable future.

Finally, ASOS has access to a £400m revolver credit with several names such as Barclays, HSBC and Lloyds, that it often renegotiates. It made headlines in late 2022 when it was announced the facility was being renegotiated. This was also the moment the company caught our eye: the market slightly panicked and sent shares down over 3% at one point over the news. It seemed to us that there was little to worry about, and when the terms of the deal came out we felt validated.

The facility went from £350m to £400m and became secured with some ASOS assets, and all existing covenants ceased until February 2024. Yes, the covenants ceasing could be worrying, but when looking at the company in detail, this just looks like more leeway given to the company in times of light restructuring.

ASOS drew £250m from this facility in September 2022. The interest rate used is linked to SONIA - the Sterling Overnight Index Average -, which was around 2% when the drawing occurred, and now is around 3.9%. We do not have other information on the interest rate, but we can estimate the interest payment for FY2023 to be around £8m.

For the future, ASOS will likely have to refinance part of the £500m convertible loan. But this will probably not occur until 2025, and if we knew where interest rates would be at then today, we would be the richest people on Earth. Thus, we prefer not to speculate too much and simply assume similar payments in the future, even though it is more likely than not that the cost of debt will be higher.

WACC / TV

We have estimated future cash flows. We have broken down the debt.

Now comes the most controversial element of any discounted cash flow analysis: estimating the company’s WACC. We will not spend too much time on this element as it is often quite subjective. We have used a 13.5% rate to discount ASOS’s future cash flows. Through a CAPM analysis, which we know is intrinsically flawed but at least provides an overall idea for a valuation, we reached 12.6% with the following parameters:

Cost of equity & Weight of equity: 18% & 68%

Risk-free rate: 4.5%, in order to anticipate future BoE rate hikes

ASOS beta: 2.9

Market risk premium: 4.5%, using a 9% market required rate of return, i.e a decades-long S&P500 average and just under twice the 1-year treasury yield.

Cost of debt & Weight of debt: 2% & 32%

This a weighted average of the convertible debt, the Nordstrom loan, and the drawn portion of the revolving credit valued at current SONIA levels. While the drawn portion of the revolving credit could have been excluded given its nature, we preferred to remain conservative.

We added 900bps to this result to provide an extra margin of safety in our calculations.

Growth rate for terminal value was estimated at 2%, as this company is still on track to massively outgrow the U.K economy in the years to come.

We have also provided a sensitivity analysis regarding WACC and terminal value:

Sensitivity analysis of our ASOS DCF. Sources: ASOS annual reports, other online information, own analysis

Competitors

The online apparel market is extremely competitive. Let’s start off with listed peers: Bohoo and Zalando. Bohoo is also a U.K online fashion retailer but provides cheaper clothes and is valued at £650m, and Zalando is a massive German online shoes and clothing retailer valued at around €10 bn.

Zara was not included as it is grouped with Inditex, H&M only has a third of its sales online, and Shein is not listed, although it is planning to hold an IPO later this year.

2025e multiples comparisons between ASOS and peers, along with analyst consensus on ASOS for that year. Please note that Bohoo fiscal year ends on the last day of February, Zalando on December 31st, and ASOS on August 31st. Calendar year sales were used to obtain more comparable revenues in the revenue growth line. Sources: ASOS, Bohoo and Zalando reports, S&P Global Market Intelligence.

The 2025E multiples shows just how cheap ASOS is, trading at less than half the multiples of its peers while having a much higher expected FCF yield. Furthermore, ASOS is expected to outgrow Zalando but grow slightly less than Bohoo during this timeframe. Still, this gap in valuation is massive.

We feel it is important to talk about the $100bn elephant in the room, or more so $64 billion now: Shein.

The ultra fast-fashion monster has been on a tear, growing from less than $2bn in sales in 2018 to over $23bn in 2021. Impressively enough, it has done so while being profitable since 2019 according to the Financial Times. With $700m in net profit in 2022, Shein had a net profit margin of 3%, about matching the estimated ASOS profit margin for FY2021 and FY2022. Thus, Shein cannot be seen as a cash burning venture that will crash itself by trying to gobble up as much market share as possible.

Yet, it is important to distinguish several aspects between ASOS and Shein that make the latter less of a threat:

Target audience: Shein targets a younger audience than ASOS’s “20-somethings”. Its main targeted audiences are Gen Z, but even more so the 16-20 year-old category, mostly female.

Value proposition: Shein offers extremely cheap clothing in both senses of the word: one can buy a dress for $5 but may not expect it to last for over six months. ASOS have improved the quality of their clothes over recent years, and yes they are still on the cheap end of overall apparel, but the products they sell are deemed to be at least far more durable than Shein products.

Ethics: Shein is constantly at the heart of controversies, for: their use of sweatshops and allegedly forced labour sometimes although the company denies it, poor supply chain overlook, alleged IP theft for clothing brands, and promoting a catastrophic ultra consumption model that is dreadful for the environment. Even many Shein customers we have spoken to turn to it now for financial reasons, but are looking to scale higher once they increase their purchasing power.

Shein is here to stay. While it may compete for some of ASOS’s market share, we do not see it as an existential threat for the company. ASOS targets mostly different customers with different products and promotes different values, let’s have a look at them.

Sustainability

Fashion is an industry that performs poorly on sustainability metrics. It is not just fast fashion, even luxury brands have dreadful, and often worse, scores than their more casual counterparts in supply chains. Overall, the fashion industry is estimated to produce between 5 to 10% of our world’s carbon emissions.

According to supply-chain sustainability tracking NGO KnowTheChain, in 2021: “The top 37 global apparel and footwear companies are failing to live up to their responsibilities and safeguard workers who are facing exploitation”. In the NGO benchmark, where ASOS was not included due to size, “Companies are failing to live up to their responsibilities and safeguard workers who are facing exploitation […] only four out of the 37 companies (11%) could demonstrate several remedy outcomes for workers, such as the repayment of unpaid wages or recruitment fees.”.

KnowTheChain 2021 benchmark of apparel and footwear companies. Source: KnowTheChain.org

Poor handling of supply chain can be disastrous, as several examples in the retail industry have recently shown:

The U.S banned imports of cotton from XinJiang after several reports came out showing evidence of mass forced labor.

Bohoo, saw its ties cut with many partners in 2020 and PwC drop them as their auditors after accusations of forced labor across its value chain were released. An investigation by U.S authorities is still going.

Legislation around supply chain is slowly becoming common, not just in the E.U but in the U.S as well, with New York having started the procedure to pass the Fashion Act, which would fine companies with over $100m in revenue by up to 2% of their sales if they did not reach certain supply chain transparency and ethics objectives.

ASOS is no angel, but it is a company that started to act on sustainability as “early” as 2010. The company has also been seeking to position itself as a champion of diversity.

ASOS’s latest sustainability action plan, Fashion With Integrity 2030 - FWI 2030 -, is built on 4 pillars:

Be Net Zero across the value chain by 2030: for instance, reduce scope 1 and 2 emissions per order by 87% vs. 2030 vs. FY2019 baseline. Between FY2016 and FY2020, ASOS reduced its operational carbon emissions per order by 45%.

Be More Circular: for instance, ensuring that 100% of ASOS own-brand products and packaging are produced using more sustainable or recycled materials by 2030.

Be Transparent: for instance, making sure 100% of ASOS own-brand products will have supply chains mapped to raw material level by 2030. So far, ASOS has covered 73% of of its supply chain. This topic in particular is key given how much the industry is intertwined with poor supply chains. Over a third of ASOS sourcing comes from China, and the majority of the rest from India and Turkey, where worker mistreatment scandals are published almost daily.

Be Diverse: for instance, achieve “at least 50% female and over 15% ethnic minority representation across our combined leadership team by 2023 and at every leadership level by 2030”. Female representation across combined leadership was at 45% in late 2021.

Risks

Investing in ASOS faces a number of risks, among which:

Execution risk: the company is aiming for profitability at the cost of some growth. While we believe a turnaround is likely, CEO José Calamonte has spent less than a year on the job, and may fail in his endeavor.

Inflation risk: if inflation were to return to consecutive months of growth, ASOS could be in jeopardy. It would not be exposed to liquidity or solvency risk quickly, but its results would undoubtedly suffer. While the company’s health may remain decent, shareholders could be subject to important losses.

Competition risk: we have gone over the hyper-competitive aspect of the online apparel industry. While we believe ASOS differentiates itself through quality and a continuous ethics campaign, it remains exposed to other competitors. While we do not believe Shein to be a massive threat, if the company succeeds in targeting higher age group and making its offer more “premium”, targets it has set out in its latest fundraising series, ASOS could be at risk.

U.K macroeconomic risk: other than the inflation risk that the U.K is exposed to like other countries today, it faces other issues. If the U.K cannot maintain a stable government, or if it presents other dreadful reforms, U.K equities will trade at further discounts to peers, widening the valuation gap.

In the case revenue growth stalls at mid-single digits in the coming years, operating margins remain at half their 2017-2021 levels of around 4.9% - excluding 2019 - and CapEx as a % of sales remains around 2021-2022 levels, we see over 50% downside to the current valuation.

Conclusion

While the company’s recent share price run-up in January has quite substantially reduced the potential upside since we initially started looking at ASOS, we believe it remains mispriced today.

We do not see a triple digit % return in this company nor a return to Covid highs in the short-term, although with consistently great execution ASOS could be a surprise.

The company’s dreadful FY2022 has led investors to excessively punish its market cap. While many of ASOS’s profitability and cash metrics are looking poor at the moment, simple key changes in strategy that a new CEO seems very willing to undertake could quickly unlock shareholder value: better inventory management alone commands a higher share price.

Overall, from the point of view of investors ASOS has gone from a growth story to a profitability one, like so many other high-flyers in growth over the past year. While some may use a shift to profitability more as an excuse to justify slower growth rather than a real strategic change, we believe that ASOS management has truly understood that it must turn a new chapter and leverage its worldwide brand recognition, supply chain, and billions in sales to now focus on providing consistent earnings growth that will allow it to generate more free cash flow than ever in just a few years’ time.

Price targets are by standard definition an objective over the next 12 months: we are willing to let management try new experiments and have some mishaps over a longer period of time, as being bold and sometimes wrong was what once made ASOS great, and we believe it is what will make it great tomorrow.

Disclaimer: I, the author, do not hold shares in ASOS plc as of the publishing of this article on March 2nd, 2023. The contents of this article do not constitute financial advice, please conduct your own due diligence.

All views expressed in this post are my own and my own only, and do not represent those of any other person or entity.

Really detailed and compelling analysis on this controversial company. I got interested in ASOS when I read about Nick Sleep's fund that allocated - maybe - a large chunk of capital (sold part of Amazon and bought ASOS and that was for me a very strong/tough decision!).

Governance still not convincing and to me this is the weakest link to a clearer and more solid bull case:

1) What's the role of the Danish largest shareholder in the appointment of the new CEO? Unclear. And again on this, they apparently searched for many months a CEO and then appointed the sales director in the role. Really confusing strategy? Moreover, the danish shareholder retains a stake in Zalando too.

2) What is going to do Fraser with the stake?

3) CFO still missing.

Good to stay in touch and monitoring.

Best regards.